Updates on RKLb Stock: Trends and Future Predictions

Introduction

The stock market is a volatile landscape, and investors are always on the lookout for promising opportunities. One such stock that has garnered attention is RKLb stock, which operates within the innovative technology sector. Understanding its recent trends and potential future outcomes is crucial for investors and analysts alike, especially in the context of market dynamics shifting due to economic factors and technological advancements.

Recent Performance and Developments

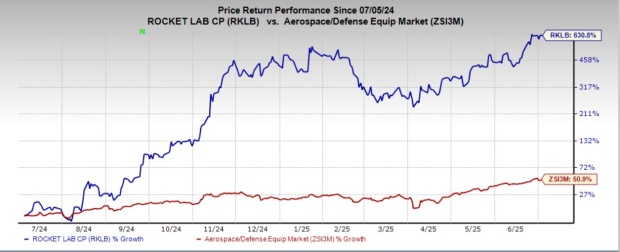

As of October 2023, RKLb stock has seen a significant fluctuation in its value. After an increase of over 30% in the last three months, it has now leveled off, currently priced around CAD 25.00 per share. Factors such as quarterly earnings reports, product launches, and market speculation have contributed to this volatility. In its latest earnings report, RKLb posted a surprising 15% increase in revenue year-over-year, attributed to robust demand for its flagship product line. The company has also announced plans for expansion into international markets, which could further boost investor confidence.

Market Trends Influencing RKLb Stock

The rising interest in technology stocks, particularly those focused on artificial intelligence and cloud computing, has played an essential role in the stock’s performance. Analysts have pointed out that the overall market sentiment towards tech stocks has shifted positively, with many investors willing to overlook short-term declines in favor of long-term growth potential. Moreover, economic factors such as interest rate adjustments by the Bank of Canada could drastically affect the technology sector’s attractiveness as an investment.

Outlook for Investors

Looking ahead, experts forecast that RKLb stock may continue to exhibit strong performance due to expanding operations and positive product reception. However, it is essential for investors to remain cautious. Economic indicators, including inflation rates and consumer spending habits, could significantly impact market conditions. Analysts recommend a diversified strategy for any investors considering RKLb, balancing between short-term trades and long-term investments.

Conclusion

In conclusion, while RKLb stock has shown positive trends and indications of growth, potential investors should approach with a degree of caution. Continuous monitoring of both company-specific developments and broader market trends will be crucial in navigating the investment landscape. As technology continues to evolve and market conditions fluctuate, RKLb stock may present new opportunities and challenges. Investors are encouraged to stay informed to make well-rounded decisions moving forward.