Understanding VOO Stock: What Investors Need to Know

Introduction

As the financial landscape continues to evolve, Exchange-Traded Funds (ETFs) have become increasingly popular among investors, with the Vanguard S&P 500 ETF, commonly known as VOO stock, standing out as a top choice. Tracking the performance of the S&P 500 Index, VOO provides investors with a diversified portfolio reflecting the broader U.S. equity market. Understanding VOO stock’s performance and its significance in your investment strategy is crucial for both novice and experienced investors.

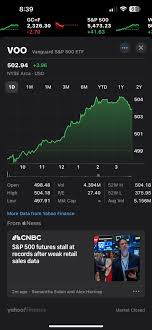

Current Performance of VOO Stock

As of October 2023, VOO stock has shown consistent growth, maintaining its status as a reliable investment option. Trading at approximately $400 per share, VOO has provided an annualized return of around 10-15% over the past decade, depending on market conditions. Recent trends indicate an increased investor interest in ETFs, particularly due to their low management fees, ease of trading, and inherent diversification.

Market Trends Influencing VOO Stock

The ongoing recovery from the COVID-19 pandemic, rising interest rates, and the shift towards sustainable investing are currently shaping the markets. Analysts are closely monitoring these factors, as they directly impact VOO stock’s performance. For instance, the continued strength of major U.S. companies within the S&P 500 Index, alongside growth in sectors like technology and healthcare, has positively influenced VOO’s price trajectory.

Investing in VOO Stock

For those considering an investment in VOO stock, it is essential to evaluate your financial goals and risk tolerance. VOO is often recommended for long-term investors looking to build wealth gradually through a vehicle that tracks well-established companies. Additionally, the ETF structure facilitates tax efficiency, making VOO an attractive option for those seeking to minimize capital gains taxes.

Conclusion

In summary, VOO stock serves as an excellent investment vehicle for those wishing to gain exposure to the U.S. stock market while mitigating risks through diversification. Analysts predict that with developing market conditions and strong underpinning fundamentals in major sectors, VOO stock will continue to be a favorable choice for many investors. As always, potential investors need to conduct their research and consider consulting with financial professionals to align their portfolios with their investment goals.