Understanding VIX: The Volatility Index and Market Sentiment

Introduction to VIX

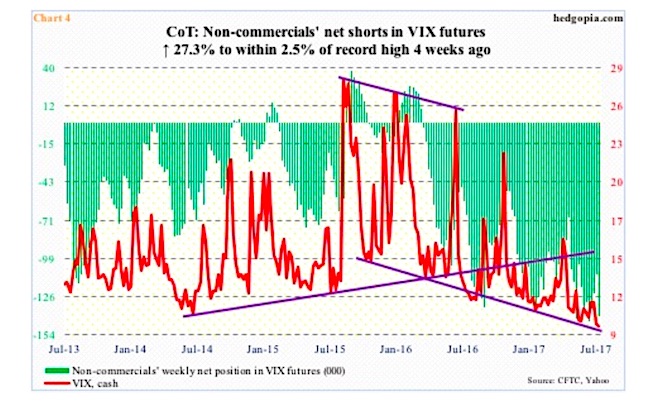

The VIX, or Volatility Index, has become a key instrument for traders and investors looking to gauge market sentiment and make informed decisions. Often referred to as the “fear gauge”, the VIX reflects the market’s expectations of 30-day volatility based on S&P 500 index options. Understanding VIX is crucial for navigating financial markets, particularly in periods of uncertainty or heightened risk.

How VIX Works

The VIX is calculated using the prices of options on the S&P 500. Specifically, it represents the market’s expectation of future volatility and is derived from the implied volatility of these options. When investors expect significant market fluctuations, the VIX rises, indicating an increase in uncertainty or fear.

Current Events and Trends

As of October 2023, the VIX has experienced fluctuations due to various macroeconomic factors, including rising interest rates, geopolitical tensions, and inflation concerns. Recently, the VIX spiked in response to announcements from central banks regarding interest rate adjustments, which investors fear could impact economic growth. Analysts have noted that periods of high volatility often coincide with significant market events, including earnings season, policy changes, and unexpected global developments.

Importance of VIX for Investors

The VIX serves multiple purposes for investors and traders. Primarily, it acts as a barometer of market risk, allowing investors to adjust their portfolios according to shifting sentiments. A high VIX value can prompt protective measures, such as diversifying investments or employing hedging strategies. Additionally, traders often use VIX derivatives for speculative opportunities based on anticipated market movements.

Conclusion

The VIX remains an essential tool for understanding market volatility and investor sentiment. Its real-time assessment of anticipated price movement plays a vital role in informed trading decisions. As we look toward 2024, ongoing economic developments will continue to influence VIX levels, providing insights into market psychology. Investors should closely monitor fluctuations in the VIX and consider how they align with their investment strategies to mitigate risks and capitalize on opportunities.