Understanding VIX Stock: The Fear Index Explained

Introduction to VIX Stock

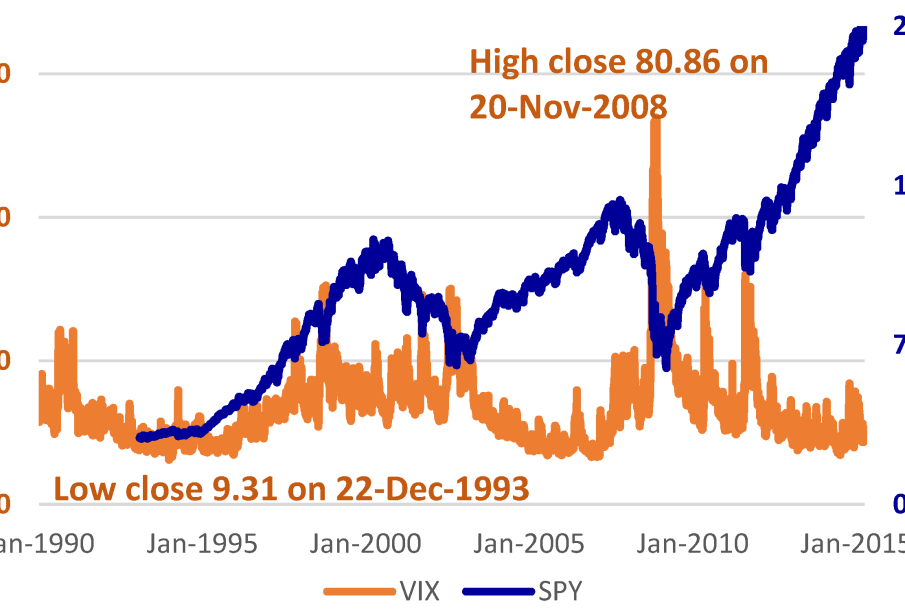

The VIX, often referred to as the ‘fear index,’ is a key measure of market volatility, derived from the pricing of options on the S&P 500. This index reflects investor sentiment and expectations regarding future market fluctuations. As economic uncertainties persist, understanding the significance of VIX stock has become increasingly important for traders and investors looking to navigate the stock market’s ups and downs.

Current Trends in VIX Stock

As of October 2023, the VIX index has been showing notable fluctuations, reflecting the growing volatility in global markets due to interest rate hikes and geopolitical tensions. Recent data indicates that the VIX has jumped over 20% in the past month, signaling heightened market concern about future economic conditions. Analysts attribute this surge to investor reactions towards escalating inflation fears and potential policy shifts from central banks.

Impact of VIX Stock on Investors

For investors, the VIX stock serves both as a barometer of market sentiment and a tool for risk management. A rising VIX typically indicates an increase in market uncertainty, prompting investors to hedge against potential losses by purchasing put options or investing in inverse exchange-traded funds (ETFs) that track the VIX. On the flip side, a declining VIX often signifies a stable or bullish market where traders feel more confident in their positions.

How to Use VIX Stock

Traders can use the VIX in a variety of ways to inform their investment strategies. Options traders often utilize the VIX to gauge the premium they can command for their options, while long-term investors may look to market volatility indicated by the VIX to decide entry and exit points for their investments. Moreover, VIX futures and options provide sophisticated market participants the opportunity to speculate or hedge against market spikes and tumbling stock prices.

Conclusion

As market volatility continues to be a significant concern, the relevance of VIX stock remains high among investors and analysts. Understanding how to read the VIX and incorporate it into investment strategies can provide valuable insights into market movements. As we look ahead, experts anticipate that the VIX will remain a crucial indicator, reflecting the burgeoning economic challenges and investor sentiment in the stock market. The ability to interpret the signals from the VIX can help investors make informed decisions, aligning with market trends for better financial outcomes.