Understanding UUUU Stock: Trends and Market Analysis

Introduction

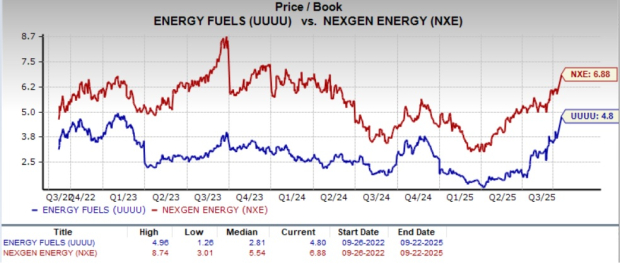

UUUU stock, representing Energy Fuels Inc., a company based in the United States, is a prominent player in the uranium industry. With the renewed global focus on nuclear energy as a sustainable energy source, the performance of UUUU stock has become increasingly relevant to investors. The rising demand for uranium and its applications in clean energy initiatives has positioned this stock within the spotlight of market analysts and investors alike.

Recent Performance and Market Trends

As of the last quarter of 2023, UUUU stock has seen significant fluctuations, reflecting broader market trends as well as specific factors affecting the uranium sector. After reaching a high of $8.50 per share in September 2023, stock analysts noted a dip to around $6.20 by October 2023, driven by concerns over supply chain disruptions and regulatory challenges in North America.

Energy Fuels has been working to enhance its mining operations, focusing on increasing uranium production, which has led to a surge in investor interest. According to the latest reports, the company has seen expanded contracts for uranium delivery, supporting positive long-term forecasts. Additionally, the rise in global nuclear energy discussions following international climate accords has added to market optimism surrounding UUUU stock.

Factors Influencing UUUU Stock

Several factors contribute to the volatility and performance of UUUU stock. Firstly, the geopolitical landscape can heavily influence uranium prices. Ongoing conflicts and changes in trade agreements may affect uranium supply chains, impacting stock values. Secondly, advancements in technology and mining efficiency at Energy Fuels’ operations are critical to maintaining competitive production costs, which also influences investor sentiment.

Moreover, the environmental push for cleaner energy sources is granting uranium renewed relevance in energy discussions. Many countries are investing in nuclear energy as a low-carbon alternative, boosting demand for uranium, which is expected to positively impact UUUU stock in the long term.

Conclusion

In conclusion, UUUU stock represents both opportunities and risks for investors navigating the volatile uranium market. With ongoing advancements in nuclear energy technology and increased demand for uranium, investors are advised to monitor Energy Fuels’ production capabilities and market movements closely. As global energy needs shift toward sustainability, UUUU stock could play an essential role in the future energy landscape, making it a noteworthy subject for investment discussions.