Understanding TSM Stock: Trends and Market Insights

Introduction to TSM Stock

TSM stock represents shares in Taiwan Semiconductor Manufacturing Company (TSMC), a key player in the global semiconductor industry. Founded in 1987, TSMC has become the world’s largest contract chip manufacturer, supplying high-performance chips to various tech giants, including Apple, Nvidia, and Qualcomm. Understanding the stock’s performance is critical for investors as semiconductor demand continues to accelerate in various sectors, including automotive, telecommunications, and consumer electronics.

Current Market Trends

As of October 2023, TSM stock has shown a strong trajectory, reflecting both positive and negative market conditions. The stock recently reached a high of $109, before experiencing a slight correction due to geopolitical tensions and fluctuating market sentiments involving technology stocks. Key factors influencing TSM’s stock performance include advancements in chip technology, expansion plans, and shifts in global supply chains.

In recent earnings reports, TSMC reported revenue growth of approximately 30% year-over-year, attributed to high demand for semiconductor products driven by AI and mobile technology applications. However, analysts caution that the stock may face headwinds from potential trade restrictions and competition from rival manufacturers, particularly from China.

Significant Developments in the Industry

Recent developments further highlight the relevance of TSMC within the industry. In September 2023, TSMC announced plans to invest $40 billion into expanding its fabrication plants in the U.S. and Europe, aiming to bolster production capabilities and address global chip shortages. This move is strategically significant as geopolitical frictions continue to motivate companies to establish more localized semiconductor supply chains.

Additionally, the advent of advanced semiconductor technologies, such as 3nm chips, is expected to contribute to TSMC’s competitive edge. Consumers and manufacturers alike are beginning to anticipate the benefits of these new technologies in enhancing efficiency and performance.

Conclusion and Stock Outlook

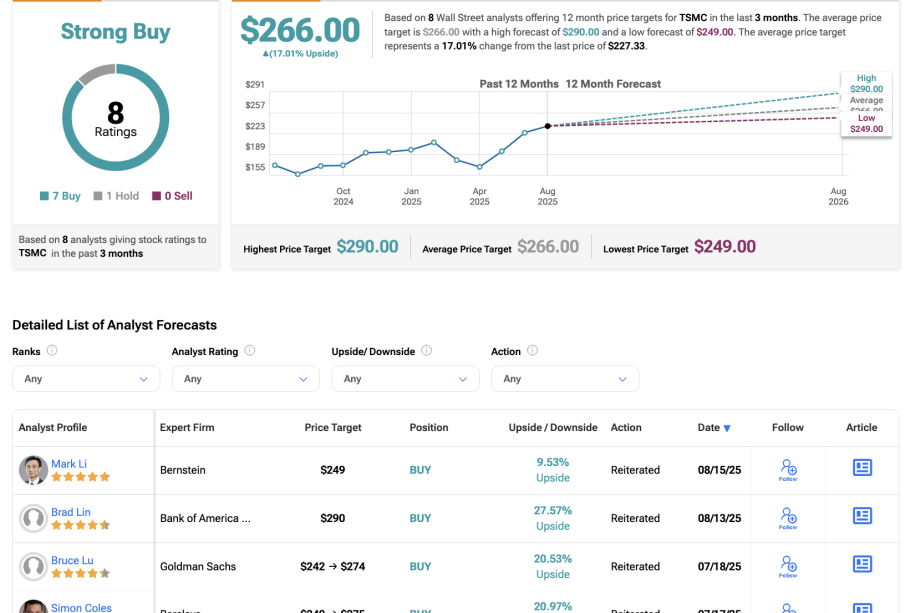

For potential investors, TSM stock presents both opportunities and challenges. The immediate outlook hinges on TSMC’s ability to navigate geopolitical tensions, maintain robust production rates, and innovate technologically. Analysts predict that with the semiconductor industry’s evolving landscape, TSMC may continue to play a pivotal role in shaping the future of technology.

In summary, while TSM stock has recently experienced fluctuations, ongoing investment in production and technology presents a hopeful scenario for long-term growth. Investors should remain cognizant of the current trends, market shifts, and the overall economic impact on the semiconductor sector.