Understanding TQQQ: A High-Risk Investment Option

Introduction

The ProShares UltraPro QQQ (TQQQ) is a leveraged exchange-traded fund (ETF) that aims to deliver thrice the daily performance of the Nasdaq-100 Index (NDX). Since its inception in February 2010, TQQQ has attracted significant attention from investors looking to capitalize on the volatility of tech stocks that compose the Nasdaq-100. With technology continuing to lead market momentum, understanding the nuances and risks associated with TQQQ is crucial for potential investors.

What is TQQQ?

TQQQ is designed for investors who are optimistic about the future performance of the Nasdaq-100 Index. It uses financial derivatives and debt to amplify returns, which allows it to provide a 3x return on a daily basis. Hence, it operates on a daily reset feature, meaning its leveraging only compounds over day-to-day fluctuations in the index. For instance, if the Nasdaq-100 rises 1% in a day, TQQQ would ideally rise 3%. Conversely, in a falling market, the losses can be magnified.

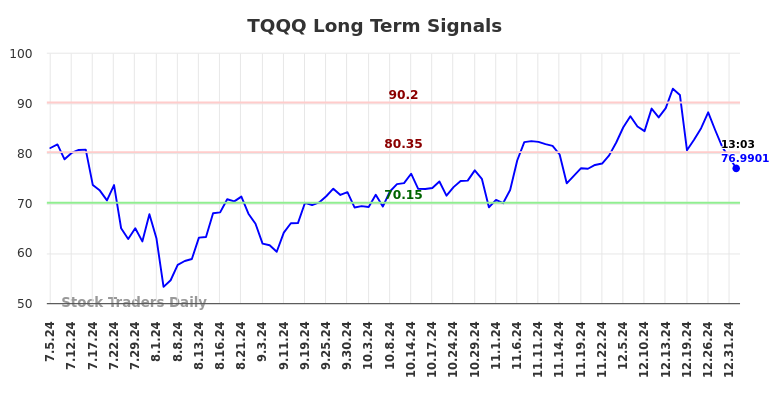

Current Performance and Market Trends

In recent months, TQQQ has exhibited both considerable gains and sharp declines, reflecting the volatile sentiment in the tech industry. As of October 2023, the Nasdaq-100 has experienced fluctuations influenced by macroeconomic factors such as inflation concerns, interest rate adjustments by the Federal Reserve, and rising geopolitical tensions. According to market analysts, TQQQ has shown a year-to-date performance of around 40% due to the resurgence of major technology companies like Apple and Amazon. However, the ETF also experienced drastic shifts: during a particularly turbulent week in late September, TQQQ dropped nearly 12% within three days.

Risks and Considerations

Investing in TQQQ comes with high risks. The leverage amplifies both gains and losses, making it unsuitable for long-term holdings. Moreover, the daily reset feature can lead to an erosion of capital during periods of high volatility—a phenomenon known as “volatility drag.” For investors considering TQQQ, it’s paramount to approach it as a tactical trading tool rather than a traditional buy-and-hold investment strategy. Risk management practices, including stop-loss orders and position sizing, can help mitigate potential losses.

Conclusion

TQQQ presents an exciting opportunity for traders looking to capitalize on short-term movements in the tech sector. However, due to its leveraged nature, it poses substantial risks that require a thorough understanding and cautious approach. As the market landscape evolves, investors should continuously assess their strategies while keeping an eye on economic indicators that could affect the Nasdaq-100. With informed decision-making, TQQQ can serve as a viable option for those willing to manage its inherent risks.