Understanding TQQQ: A Comprehensive Guide for Investors

Introduction to TQQQ

The ProShares UltraPro QQQ (TQQQ) is a leveraged exchange-traded fund (ETF) that seeks to provide three times the daily performance of the Nasdaq-100 Index. With the increasing popularity of ETFs, TQQQ has gained significant attention from both retail and institutional investors. Understanding TQQQ is crucial for those looking to capitalize on momentum within the tech sector, especially in a market characterized by rapid changes and volatility.

TQQQ Performance Overview

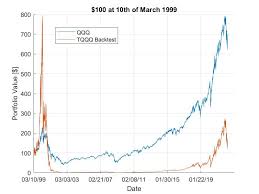

In 2023, TQQQ has seen considerable fluctuations corresponding to the wider tech market’s performance. As of September 2023, TQQQ has experienced returns exceeding 100% year-to-date, driven primarily by surges in technology stocks and positive earnings reports from major companies like Apple, Microsoft, and Amazon. However, this performance comes with inherent risks, as the leveraged nature of the ETF means that losses can also be magnified. Investors should be aware that TQQQ is designed for short-term trading rather than long-term holding.

Potential Risks and Volatility

Investing in TQQQ involves significant risks. The use of leverage means that while gains can be substantial during bullish market conditions, losses can also escalate quickly in downturns. For instance, in the event of a market correction, TQQQ can decline rapidly, often outpacing losses in non-leveraged ETFs. Furthermore, the structure of TQQQ means it resets daily, which can lead to greater volatility and compounding effects over longer holding periods. Investors must be equipped to manage these risks and have a defined strategy.

Conclusion: TQQQ in the Future

As the market landscape continues to evolve, TQQQ remains a beacon for those aiming to leverage the tech sector’s potential. Investors must weigh the potential high rewards against the associated risks carefully. For those considering TQQQ, education around market timing, market trends, and risk management will be integral to optimizing their investment strategy. With the increasing interest in technology stocks and an unpredictable economic environment, TQQQ’s role in investment portfolios may continue to grow, sparking further interest in leveraged products among savvy investors.