Understanding the USDCAD Exchange Rate and Its Impact

Introduction to the USDCAD Exchange Rate

The exchange rate between the US dollar (USD) and the Canadian dollar (CAD), known as USDCAD, plays a crucial role in global trade and finance. Recent fluctuations in this rate reflect economic shifts, monetary policies, and geopolitical events. Monitoring the USDCAD exchange rate is vital for traders, investors, and businesses that operate between the United States and Canada.

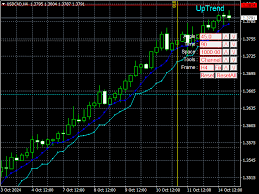

Current Trends in USDCAD

As of October 2023, the USDCAD exchange rate has shown notable volatility, primarily influenced by the Bank of Canada’s recent interest rate decisions and the Federal Reserve’s monetary policy direction. The CAD has been under pressure due to signs of a slowing economy in Canada, while the USD has seen strength from America’s robust job market and higher interest rates.

Recent data indicated that Canada’s inflation rate remained stubbornly above the central bank’s target, prompting cautious responses from policymakers. In contrast, the US Federal Reserve maintained its stance on potential rate hikes, reinforcing the dollar’s strength against foreign currencies, including the CAD. On October 15, 2023, the USDCAD exchange rate was recorded at 1.36, showcasing the USD’s continued dominance.

Factors Influencing the Exchange Rate

A multitude of factors affect the USDCAD rate, including commodity prices, particularly oil, as Canada is a significant oil exporter. Changes in crude oil prices can quickly influence investor sentiment about the CAD. Furthermore, political stability, trade agreements, and relations between the two countries also play a role in shaping the exchange rate.

Moreover, investor perceptions around economic data releases, such as employment statistics and GDP growth rates, often result in immediate reactions in the USDCAD exchange rate. As both US and Canadian economies intertwine, any economic shift in one can reverberate through the other, accentuating the exchange rate’s importance.

Conclusion: Looking Ahead

In conclusion, the USDCAD exchange rate is not only a barometer of trade relations between Canada and the United States but also an indicator of broader economic health. Analysts predict that shifts in monetary policy from both sides of the border will continue to drive this rate in the coming months. As global economic conditions evolve, businesses and investors are encouraged to stay informed about potential impacts on the USDCAD rate.

Given the current trajectory, a careful watch on economic indicators, central bank decisions, and geopolitical developments will be essential for understanding the future movements of the USDCAD exchange rate.