Understanding the TFSA Tax Trap in Canada

Introduction

The Tax-Free Savings Account (TFSA) is a popular investment vehicle in Canada that offers tax advantages and flexibility for savers. However, many Canadians are unaware of the potential pitfalls associated with TFSAs, particularly what is known as the “TFSA tax trap.” This article aims to shed light on this topic and provide insights on how to navigate it effectively.

The TFSA Basics

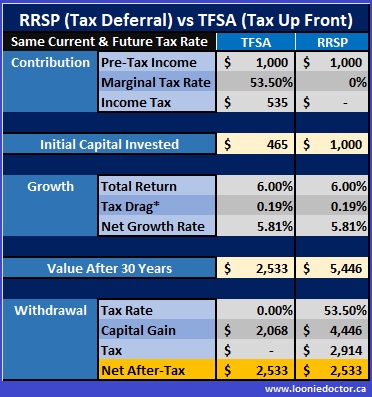

The TFSA was introduced in 2009, allowing individuals over 18 years old to contribute and grow savings tax-free. Contributions to a TFSA do not provide a tax deduction, but withdrawals and the growth within the account are tax-exempt, making it an attractive option for many Canadians.

What is the TFSA Tax Trap?

The TFSA tax trap can occur when individuals exceed their annual contribution limits. While TFSA contribution limits have increased over the years (from the initial $5,000 to $6,000 as of 2019 and $6,500 in 2023), excessive contributions can lead to significant penalties. Specifically, individuals may incur a 1% tax penalty on the excess amount for each month it remains in the account.

For instance, if an individual over contributes $2,000, they could face a monthly penalty of $20 until the excess funds are withdrawn. Many Canadians mistakenly believe they can re-contribute any amount withdrawn in a given year, but this misconception can lead to over-contribution if not carefully monitored.

Recent Developments and Cases

Recent reports have highlighted cases where Canadians faced substantial penalties due to confusion regarding contribution limits. The Canada Revenue Agency (CRA) has been working to educate the public on these matters, promoting the importance of tracking contributions and understanding the rules. Additionally, financial institutions have begun providing better tools to help clients monitor their TFSA contributions and avoid the tax trap.

Preventive Measures

To avoid falling into the TFSA tax trap, Canadians are encouraged to:

- Track contributions closely and know the annual limits.

- Understand how withdrawals affect available contribution room.

- Utilize online calculators and tools provided by financial institutions.

- Consult with financial advisors or tax professional if uncertain.

Conclusion

The TFSA remains an essential tool for tax-free savings in Canada, but it is crucial for investors to remain aware of the associated pitfalls. Understanding the TFSA tax trap and following preventive measures can help Canadians maximize their savings and avoid unnecessary penalties. As the government continues to adapt and respond to changing economic conditions, it is advisable to stay informed about any adjustments to TFSA limits and tax implications.