Understanding the TFSA Contribution Limit for 2026 in Canada

Introduction

The Tax-Free Savings Account (TFSA) has been a popular savings vehicle in Canada since its introduction in 2009, allowing Canadians to save without incurring tax on interest, dividends, or capital gains. Understanding the annual contribution limits is crucial for individuals looking to maximize their tax-free savings. As Canadians prepare for 2026, knowing the contribution limit is essential for effective financial planning.

TFSA Contribution Limit for 2026

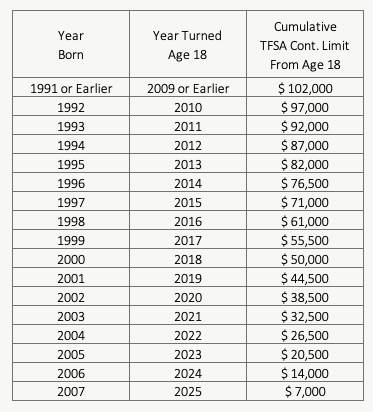

Based on recent announcements, the TFSA contribution limit for 2026 is expected to reach $7,000. This increase comes as a part of the adjustments made by the Canada Revenue Agency (CRA) that accounts for inflation. The cumulative limit for those who have been eligible since its inception now stands at $88,000 by the end of 2026 for individuals who have never contributed.

It is important to note that the limit increases are reviewed annually, and the CRA announces any changes generally in the fall preceding the new tax year. The 2026 threshold marks a continuation of gradual increases that have helped Canadians adapt to rising living costs while encouraging them to save

Impact on Canadians

The increase in the TFSA limit is significant, enabling Canadians to save more tax-free. This additional room can especially benefit younger individuals who are starting their savings journey or those looking to catch up on their savings after a period of financial strain. Financial institutions typically offer a variety of TFSA investment options, ranging from high-interest savings accounts to mutual funds, allowing individuals to choose a suitable path based on their financial goals.

Moreover, TFSAs can play a vital role in long-term strategies, including retirement savings or large purchases, such as a first home or education. The ability to withdraw funds tax-free provides flexibility and encourages savings behavior among Canadians.

Conclusion

The announcement of the TFSA contribution limit for 2026 as $7,000 highlights the government’s commitment to supporting Canadians in their savings goals. As more individuals become aware of this beneficial saving tool, the anticipated increase in limits will empower Canadians to take charge of their finances more effectively. For individuals and families planning their financial futures, understanding these limits and maximizing contributions can make a significant difference in financial security.