Understanding the TFSA Contribution Limit for 2026

Introduction

The Tax-Free Savings Account (TFSA) is a crucial investment tool for Canadians, allowing individuals to save money tax-free. As contributions to these accounts can significantly impact one’s financial growth, it is vital for Canadians to stay informed about the contribution limits set for each year. The TFSA contribution limit for 2026 has recently been released, which affects savings strategies and investment plans for numerous individuals.

Details on the 2026 Contribution Limit

For the year 2026, the TFSA contribution limit has been established at $6,500. This marks an increase from the previous limits of $6,000 in 2021, 2022, and 2023, and represents a consistent approach by the government to adjust limits slowly following inflation trends. These figures are determined based on the consumer price index and government policies aimed at encouraging saving among Canadians.

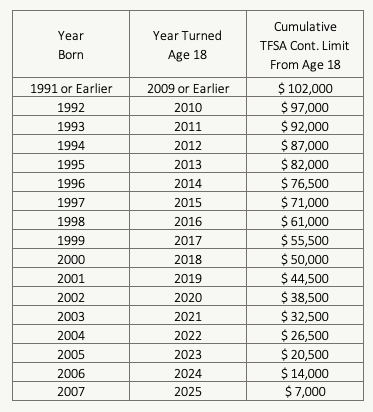

The steady increase in contribution limits allows individuals to maximize their investment potential. For those who have been contributing to their TFSA since its inception in 2009, their cumulative contribution room will reach $88,000 by the end of 2026, provided they have not made any withdrawals from their accounts.

Importance for Canadian Investors

The TFSA is popular among Canadians for various reasons, including its tax-free growth potential and flexible withdrawal options. As many Canadians are looking toward their financial futures amidst economic uncertainty, understanding the contribution limits is essential for strategic planning. The increase in the contribution limit is expected to encourage more individuals to invest in TFSAs, which can lead to enhanced retirement savings and increased financial stability.

Conclusion

In summary, the TFSA contribution limit for 2026 is set at $6,500, incorporating a modest increase to encourage savings. This adjustment is part of a broader trend aimed at helping Canadians build wealth without the burden of tax implications. As citizens prepare for financial security, being informed of such changes in contribution limits will allow them to make informed investment decisions. The government’s continued commitment to supporting TFSA growth is likely to remain a vital element of Canada’s financial landscape in the years to come.