Understanding the TD Prime Rate and Its Economic Impact

Introduction

The TD Prime Rate, a critical benchmark for financial lending in Canada, plays a significant role in influencing interest rates for various loans and mortgages. As Canada’s economy continuously evolves, monitoring changes in the prime rate is essential for consumers and businesses aiming to make informed financial decisions. Understanding the nuances of the TD Prime Rate will aid individuals in planning their financial futures and grasping broader economic trends.

What is the TD Prime Rate?

The TD Prime Rate is the interest rate that The Toronto-Dominion Bank (TD) charges its most creditworthy customers on short-term loans. This rate is crucial as it often acts as a base rate for loans, including personal loans, mortgages, and other forms of credit. Changes to the TD Prime Rate can influence the cost of borrowing, thus impacting consumer spending and overall economic growth.

Recent Changes and Economic Implications

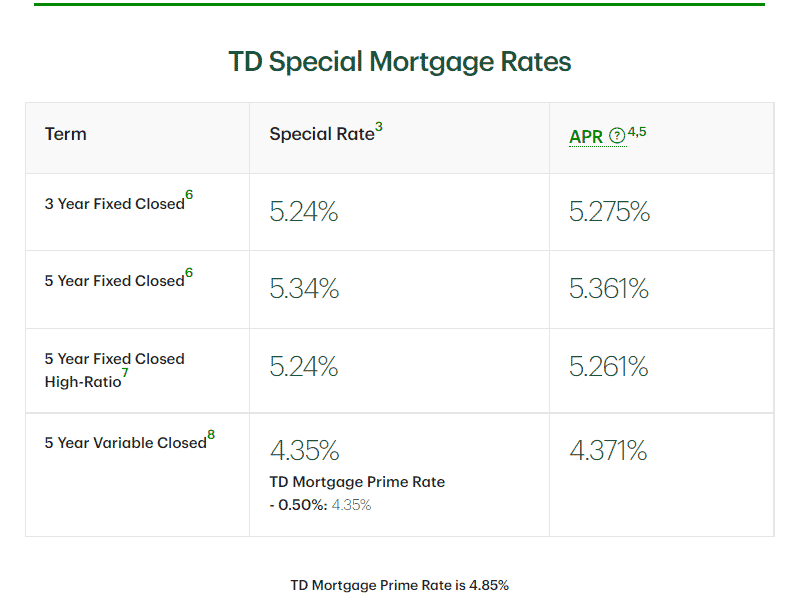

As of October 2023, the TD Prime Rate stands at 7.20%, which is consistent with the increasing trend observed over the last year. The Bank of Canada has indicated an intention to keep rates elevated to combat inflation. Consequently, many economists and financial analysts speculate that the TD Prime Rate may remain steady or experience slight adjustments in the near future, depending on inflationary pressures and other economic indicators.

This elevated prime rate translates into higher interest on various types of loans and mortgages. Consumers may feel the pinch through increased monthly payments, which could influence their purchasing power and, in turn, affect the housing market and consumer confidence.

Conclusion

The TD Prime Rate is more than just a figure; it is an indicator of the Canadian economic landscape. As Canadians navigate a complex financial environment, staying informed about the prime rate’s fluctuations is essential. The rate’s stability or volatility will play a pivotal role in shaping spending habits and financial strategies for the foreseeable future. For individuals and businesses alike, understanding the implications of the TD Prime Rate can lead to smarter financial decisions, making it a crucial element to monitor in the coming months.