Understanding the SP500 and Its Market Impact

Introduction to the SP500

The S&P 500, or SP500, is one of the most watched stock market indices in the world, representing 500 of the largest publicly traded companies in the United States. Its performance is often viewed as a reflection of the overall health of the U.S. economy. As investors and analysts closely monitor its fluctuations, understanding its dynamics becomes essential for both seasoned traders and those new to investing.

Current Trends in the SP500

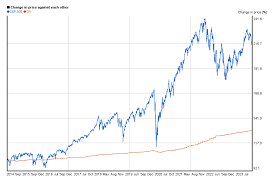

As of October 2023, the S&P 500 has shown significant resilience amidst global economic uncertainties. Recent reports indicate that the index has gained approximately 15% year-to-date, driven by robust earnings reports from key sectors such as technology and healthcare. This growth is particularly noteworthy as it comes against a backdrop of rising interest rates and inflation concerns.

The recent increase in market volatility, ignited by geopolitical tensions and ongoing concerns about supply chain disruptions, has further spurred discussions about the index’s long-term trajectory. Despite these challenges, analysts maintain an optimistic outlook, suggesting that strong corporate fundamentals and consumer spending could sustain the index’s momentum.

Factors Influencing SP500 Movements

Several factors impact the performance of the S&P 500. Economic indicators such as GDP growth, employment rates, and inflation levels play crucial roles in shaping investor confidence. For instance, the recent drop in unemployment rates has boosted optimism, contributing to the index’s upward trend. Moreover, sectoral performance varies: while technology stocks have surged, energy and utilities remain under pressure due to fluctuating oil prices.

Additionally, monetary policy influences the SP500. The Federal Reserve’s decisions regarding interest rates have historically impacted stock prices; a lower interest environment tends to enhance equity investments, while higher rates may detract from stock market growth.

Conclusion and Future Outlook

The S&P 500 remains a vital indicator of market health and investor sentiment. Although potential risks loom, including inflationary pressures and global events, the underlying strength of the index appears promising. Experts foresee that as long as corporate earnings remain strong and consumer confidence is restored, the S&P 500 will likely continue its upward trajectory in the near future.

For investors, closely monitoring the SP500 can provide insights into overall market conditions, helping to guide investment decisions effectively. Understanding the interplay of economic factors, sector performance, and Federal Reserve policy will be crucial as we approach the end of 2023.