Understanding the S&P 500: Trends and Implications for 2023

Introduction

The S&P 500, a key benchmark of U.S. equities, consists of 500 of the largest publicly traded companies in the United States. It serves as a crucial indicator of market performance and investor sentiment. Understanding the S&P 500 is essential for both individual and institutional investors as it reflects overall economic health and influences investment strategies.

Recent Trends

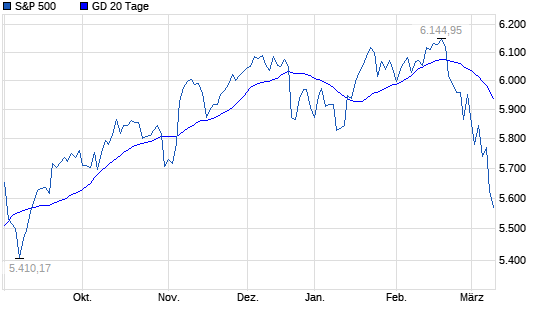

As of October 2023, the S&P 500 has experienced significant fluctuations influenced by macroeconomic factors, including interest rate changes, inflation, and geopolitical events. Following a robust bullish run in early 2023, the index saw a correction mid-year, prompting concern among investors about a potential recession. However, the third quarter has shown signs of recovery, supported by strong earnings reports from major firms, particularly in the technology and energy sectors.

Key Drivers of Performance

Several factors continue to drive the performance of the S&P 500. The ongoing adjustments in monetary policy by the Federal Reserve play a crucial role. Recent statements indicate a potential pause in interest rate hikes, aimed at stabilizing the economy. This has led to renewed investor confidence, reflected in the rising stock prices of tech giants such as Apple and Microsoft, which form a significant portion of the index.

Market Predictions

Looking ahead, analysts project that the S&P 500 may experience continued volatility as it reacts to economic data releases and corporate earnings reports. The balance between inflation control and economic growth remains delicate, and any new developments in fiscal policy or global events could sway the market significantly. Investors are advised to stay informed and consider diversification as a strategy to mitigate risks associated with market fluctuations.

Conclusion

The S&P 500 remains a vital barometer for gauging U.S. economic performance and investor sentiment. As the market navigates through uncertainties in the coming months, understanding the trends and implications associated with the S&P 500 will be essential for making informed investment decisions. Staying updated on economic indicators, corporate earnings, and overall market health can empower investors to adapt their strategies in this ever-changing financial landscape.