Understanding the Sensex: Importance and Recent Trends

Introduction

The Sensex, officially known as the S&P BSE Sensex, is one of the most important stock market indices in India. It reflects the performance of the Bombay Stock Exchange (BSE), tracking the highest-performing 30 companies listed on the exchange. As a barometer of the Indian economy, the Sensex is crucial for investors, policymakers, and economists alike, providing insights into market sentiments, economic health, and investment opportunities.

Current Trends and Performance

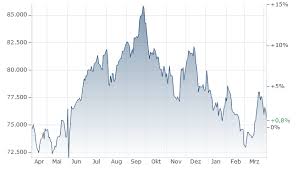

As of October 2023, the Sensex has experienced notable fluctuations amid global economic uncertainty, high inflation rates, and geopolitical tensions. On October 15, 2023, the index closed at 65,000 points, reflecting a year-to-date increase of approximately 12%. Analysts attribute this growth to robust earnings reports from key sectors such as technology, consumer goods, and banking, alongside strong foreign institutional investments into Indian markets. Recent comments from the Reserve Bank of India (RBI) regarding interest rates have also provided a boost to investor confidence.

Despite these positive trends, volatility persists. Factors such as rising commodity prices and fears of a global recession continue to pose challenges. Market experts suggest that short-term investors should stay vigilant as the market adjusts to these external pressures.

Impact of Sensex on Investors

The Sensex serves as a critical indicator for both domestic and international investors. Fluctuations in the index can influence investment decisions and market strategies. For instance, a significant drop in the Sensex, as seen during the initial Covid-19 lockdowns in 2020, can trigger panic selling, impacting not only investors but also the broader economy. Conversely, upward trends often lead to increased trading volumes and investor participation.

Conclusion

Understanding the dynamics of the Sensex is essential for anyone engaged in the financial markets. It not only reflects current market sentiment but also indicates overall economic conditions in India. For the foreseeable future, as the global economy stabilizes, the Sensex is expected to continue being a focal point for investors. Such developments will determine investment flows and strategies in the Indian stock market, emphasizing the need for continual monitoring of both domestic and international factors impacting this crucial financial index.