Understanding the Recent US Interest Rate Announcement

Introduction

The recent US interest rate announcement has drawn significant attention from investors, economists, and consumers alike. As the Federal Reserve navigates a complex economic landscape, the decisions made regarding interest rates can have profound effects on economic growth, inflation rates, and consumer spending. Understanding the implications of recent announcements is crucial for many seeking to make informed financial decisions.

Recent Developments

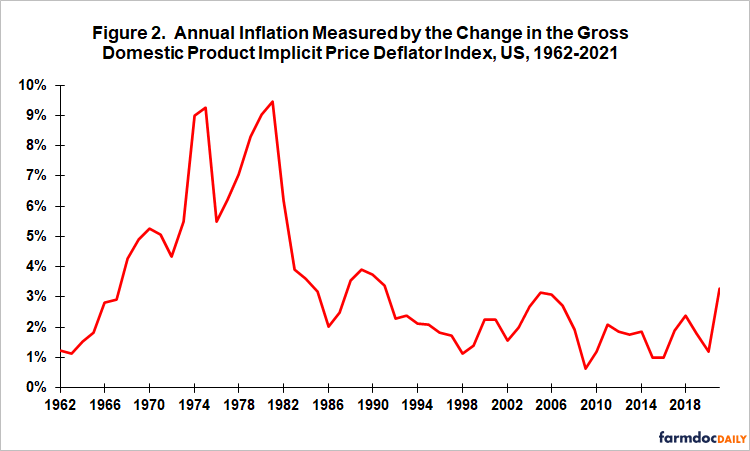

On September 20, 2023, the Federal Reserve announced that it would keep the benchmark interest rate unchanged at a range of 5.25% to 5.50%. This decision came after a series of rate hikes throughout 2022 aimed at combating rising inflation rates that peaked at over 9%. The Fed’s current stance reflects a cautious approach in balancing the need to sustain economic growth while continuing to monitor inflation.

The Fed Chair, Jerome Powell, emphasized during the press conference that the committee remains committed to the 2% inflation target while acknowledging mixed signals from the economy. Employment numbers have shown resilience, but external factors, including geopolitical tensions and labor market fluctuations, continue to create uncertainty.

Economic Impact

The decision to hold interest rates steady comes with mixed implications. For consumers, lower interest rates typically mean more accessible loans and mortgages, encouraging spending and investment. On the other hand, if inflation remains high, there’s potential for the Fed to implement further rate hikes in upcoming meetings, which could raise borrowing costs.

Market reactions have been varied. After the announcement, US stock markets experienced volatility, reflecting investor concerns about future economic stability. Analysts suggest the Fed’s next moves will depend heavily on inflation trends and economic indicators in the coming months.

Conclusion

The latest US interest rate announcement highlights the balancing act the Federal Reserve faces in stabilizing the economy amidst ongoing challenges. Moving forward, the focus will be on inflationary pressures, job market performance, and global economic conditions. Consumers and businesses alike should remain vigilant to how these rates affect their personal finances and strategic planning. As we approach the end of the year, many will be watching closely for signs of whether the Fed will adjust interest rates in response to economic developments.