Understanding the Recent Trends in Oil Price

Introduction

The fluctuations in oil prices have a far-reaching impact on the global economy, influencing everything from transportation costs to consumer spending. As countries around the world navigate the complexities of energy transition and geopolitical tensions, understanding the dynamics behind oil pricing has never been more crucial. With major developments in the oil market occurring regularly, keeping abreast of these changes helps investors, businesses, and policymakers make informed decisions.

Recent Developments

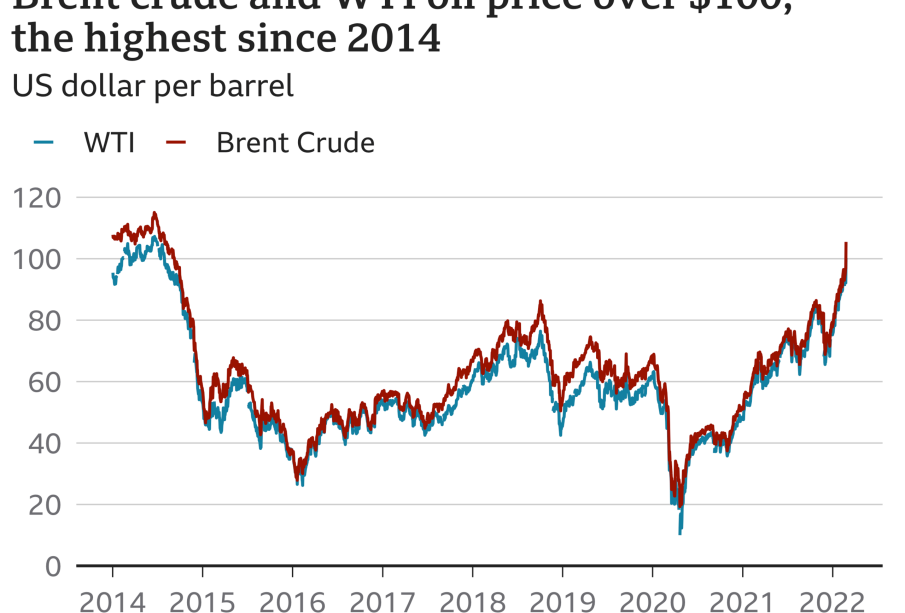

As of October 2023, oil prices have seen significant volatility, primarily driven by geopolitical tensions in Eastern Europe and the Middle East. According to the latest data from the U.S. Energy Information Administration (EIA), global crude oil prices have experienced an uptick, with Brent crude reaching approximately $95 a barrel recently, marking a near 30% increase from earlier in the year.

The rising prices have been attributed to several factors, including supply chain disruptions, increased demand in recovering economies post-COVID, and OPEC+ production cuts initiated to stabilize the market. Notably, OPEC’s decision to maintain production levels despite increasing demand has raised eyebrows among energy analysts, who suggest this could lead to prolonged higher prices.

Additionally, the situation has been exacerbated by sanctions on certain petroleum exports and evolving climate policies that are affecting fossil fuel supply dynamics. Experts project that uncertainties in the market, alongside seasonal changes in demand, could continue to drive prices upwards in the coming months.

Impact and Implications

The rising oil prices carry profound implications for the broader economy. Higher energy costs typically lead to increased inflation, affecting consumer behavior. This is particularly significant as central banks globally are already grappling with inflation rates. Additionally, transportation and manufacturing sectors could see increased operational costs, which may be passed on to consumers in the form of higher prices for goods and services.

For investors, navigating the oil market can be complex but also presents opportunities. Investors are advised to keep an eye on geopolitical developments, OPEC’s announcements, and inventory levels, all of which could significantly sway market performance.

Conclusion

In summary, the current landscape of oil prices presents both challenges and opportunities. As global demand continues to evolve alongside geopolitical dynamics, staying informed about trends in oil pricing is more critical than ever. Stakeholders across all sectors must remain vigilant to the potential shifts in the oil market, which promise to shape economic conditions for the foreseeable future.