Understanding the Recent FOMC Meeting and Its Impact

Introduction

The Federal Open Market Committee (FOMC) plays a crucial role in shaping U.S. economic policy. As a subgroup of the Federal Reserve, the FOMC meets regularly to discuss and determine monetary policy, which is significant for interest rates, inflation, and employment levels across the country. With the FOMC’s recent meeting held on October 31, 2023, the outcomes are essential not only for the U.S. economy but also for global markets, making it a topic of high interest for economists, policymakers, and the general public alike.

Details from the Recent Meeting

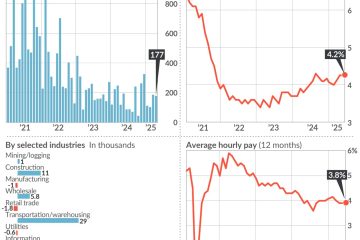

During the latest FOMC meeting, officials decided to maintain the federal funds rate at the current range of 5.25% to 5.50%, signaling a cautious approach towards economic stability. Federal Reserve Chair Jerome Powell highlighted persistent inflationary pressures and labor market tightness as ongoing concerns. However, the decision to pause rate hikes reflects a balancing act between controlling inflation and supporting economic growth.

Furthermore, the FOMC’s updated economic projections indicate a gradual decrease in inflation rates, forecasting a fall to around 3.2% in 2024. This represents a positive shift from earlier predictions and reflects the Fed’s commitment to ensuring price stability without hindering economic recovery.

Reactions and Implications

Market reactions to the FOMC meeting have been largely supportive, as equity indexes rose in anticipation of continued economic growth without the pressure of rising interest rates. Analysts also believe that by holding rates steady, the FOMC aims to foster an environment conducive to job creation and investment.

The decision has garnered mixed reactions from political figures and economists. Some argue that maintaining higher rates could still restrain consumer spending, while others support a cautious approach to avoid potential economic shocks.

Conclusion

The latest FOMC meeting underscores a pivotal moment in U.S. economic policy as the committee navigates complex inflation rates and market dynamics. As economic indicators begin to stabilize, the Federal Reserve’s decisions will remain influential in shaping financial landscapes. With prospects for a potential rate cut in the coming year, stakeholders are encouraged to stay informed about these developments. Understanding the FOMC’s actions and projections is vital for anticipating future economic conditions, making this ongoing dialogue between fiscal responsibility and economic growth a key watchpoint for investors and citizens alike.