Understanding the Latest Inflation News in Canada

Introduction

As inflation remains a focal point for governments and economists worldwide, understanding its latest developments in Canada has become crucial for citizens and businesses alike. The Consumer Price Index (CPI) has shown fluctuating trends, significantly impacting consumers’ purchasing power and the overall economic climate. This article aims to explore the current state of inflation in Canada, recent data reports, and what they mean for the future.

Current State of Inflation in Canada

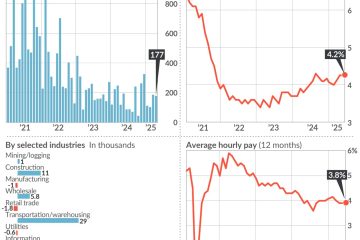

According to the most recent report from Statistics Canada, the inflation rate as of September 2023 stands at 3.8%, which represents a slight decline from the previous month. The government flagged a noticeable decrease in energy prices; however, food costs continue to rise steadily. This diverging trend has raised concerns among Canadian households, as grocery bills become increasingly burdensome.

Key Factors Driving Inflation

Several key factors have been identified as contributors to the current inflation environment in Canada:

- Supply Chain Disruptions: Ongoing disturbances in global supply chains due to geopolitical tensions and lingering COVID-19 impacts have caused delays in product availability.

- Increased Demand: As restrictions ease, consumer demand has surged, particularly in the services and travel sectors, creating upward pressure on prices.

- Wage Growth: With many regions facing labor shortages, wages have begun to rise, leading to increased operational costs that businesses often pass on to consumers.

Government Response

The Government of Canada has stated its commitment to addressing inflation by pursuing balanced fiscal policies. Recent discussions in Parliament have focused on potential measures such as adjusting interest rates through the Bank of Canada. Analysts believe that prompt actions are necessary to ward off further rate hikes and keep inflation in check. Central bank officials have indicated that their main goal remains the stabilization of prices to ensure economic viability and consumer confidence.

Conclusion

As inflation continues to be a pressing issue, both consumers and policymakers must remain vigilant. The rising costs of living are a significant concern for the average Canadian, and understanding the underlying factors is vital in preparing for the potential outcomes in the near future. Experts predict that while inflation may fluctuate, ongoing monitoring and proactive measures by the government will be essential in steering the economy toward stability. For Canadians, staying informed about inflation news is crucial for making informed financial decisions amidst these challenging economic times.