Understanding the Latest CPI Report and Its Implications

Introduction

The Consumer Price Index (CPI) report is a crucial economic indicator that measures inflation by tracking changes in the price level of a basket of consumer goods and services over time. This data is fundamental for policymakers, businesses, and consumers as it directly affects interest rates, purchasing power, and overall economic health. As inflationary pressures continue to challenge the Canadian economy, recent CPI reports have garnered significant attention and debate.

Recent CPI Developments

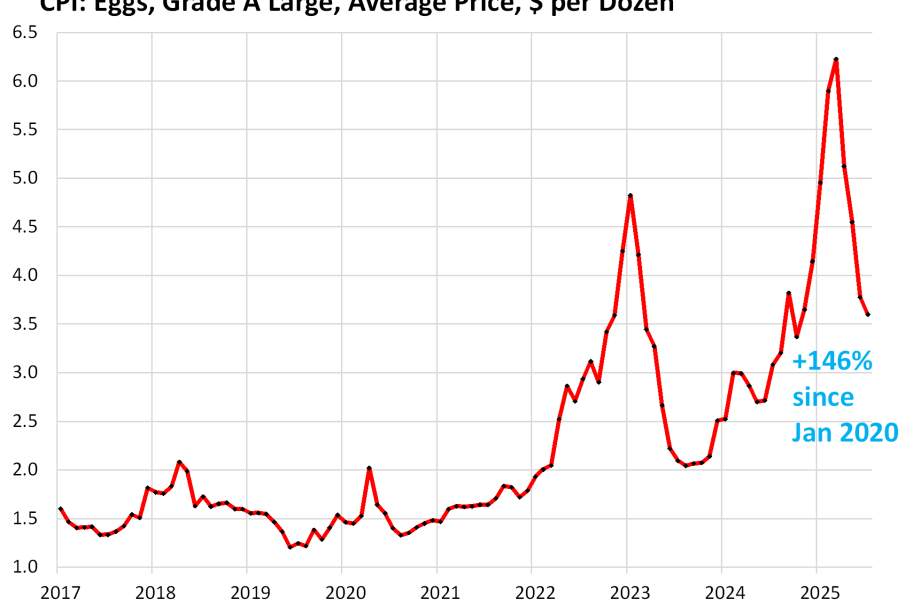

According to the latest CPI report released by Statistics Canada on October 18, 2023, the annual inflation rate stood at 4.1% in September, slightly down from 4.4% in August. This decline was partially attributed to decreasing energy prices, specifically gasoline, which fell 8.5% year-over-year. However, food prices continued to rise, contributing to ongoing concerns among consumers as grocery bills have increased more than 13% compared to the previous year.

The report indicated that while transportation and energy costs have shown some moderation, sectors like shelter and food have been less forgiving. The cost of rent and homeowners’ replacement costs surged 6.6% and 5.8%, respectively, highlighting the ongoing housing affordability crisis in major Canadian cities.

Implications for Consumers and the Economy

The implications of the CPI report are profound. As inflation remains above the Bank of Canada’s target rate of 2%, the central bank may consider further increases to interest rates to curb spending and stabilize prices. This approach can lead to higher mortgage rates and borrowing costs for consumers, impacting their disposable income and spending habits.

Additionally, businesses are closely monitoring these trends as they prepare to adjust pricing strategies and cost management. The sustained increase in food prices poses a significant challenge for consumers, particularly low-income families, who spend a larger portion of their budget on essentials.

Conclusion

The latest CPI report reflects a mixed bag of trends, with some prices moderating while others remain high, particularly in essential categories like housing and food. As we move forward, economists suggest that the path of inflation will depend on a combination of energy prices, global supply chain factors, and domestic economic policies. Consumers and businesses alike will need to navigate this volatile environment as they make financial decisions. Ongoing analysis of CPI reports will remain crucial for understanding and responding to economic conditions in Canada.