Understanding the Fluctuations in Gold Price

Introduction

The price of gold is a crucial indicator of economic stability and investor confidence. In recent months, it has gained heightened attention due to fluctuations influenced by various global factors, including inflation, interest rates, and geopolitical tensions. As investors seek safe-haven assets amid uncertainty, understanding the factors affecting the gold price becomes increasingly important.

Current Trends in Gold Price

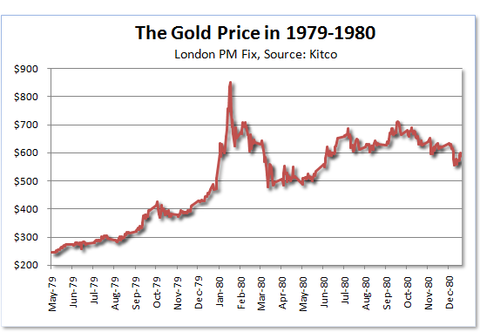

As of October 2023, the gold price is hovering around CAD 2,900 per ounce, reflecting a significant increase compared to earlier in the year. Analysts attribute this surge to rising inflation rates and expectations that the Bank of Canada may continue its policy of monetary tightening. Historical data shows that gold has often served as a hedge against inflation, prompting more investors to consider it during uncertain times.

Global Economic Factors

Several global events are contributing to the volatility in gold prices. Recently, conflicts in Eastern Europe, fluctuating oil prices, and trade tensions among major economies have led to increased trading in precious metals. Furthermore, the ongoing concerns around the COVID-19 pandemic continue to impact market sentiment, reinforcing gold’s appeal as a secure investment.

Investment Trends

Investing in gold has evolved significantly over the years. More investors are not only purchasing physical gold but also ETFs (Exchange-Traded Funds) that track gold prices, providing them with a liquid form of this asset. As technology progresses, the ease of investing in gold has attracted millennials and new investors, further expanding its market base.

Market Forecast

Looking ahead, analysts predict that gold prices may continue to rise if inflation remains unchecked and geopolitical uncertainties persist. The anticipated stabilization efforts by global central banks may lead to heightened demand for gold as a hedge against currency devaluation. Forecasting gold prices remains complex, but experts suggest monitoring inflation rates and central bank policies closely, as they will likely play a significant role in future movements.

Conclusion

In conclusion, the current trends in gold prices demonstrate its important role as a safe-haven asset amidst economic uncertainty. For investors, tenuring the market’s dynamics surrounding gold pricing could yield fruitful opportunities. Keeping an eye on global economic indicators will be critical for anyone interested in gold investment as they navigate their financial strategies.