Understanding the Dow Jones Stock Markets: Current Trends

Introduction

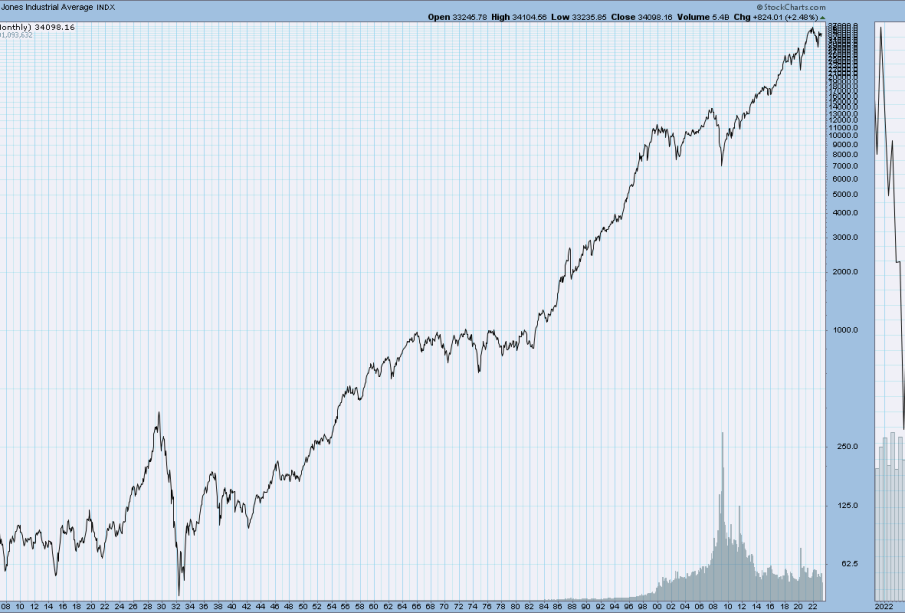

The Dow Jones Stock Markets, one of the most widely recognized financial indices globally, play a pivotal role in tracking the performance of major US companies. The significance of the Dow Jones lies in its reflection of broader economic trends, serving as a barometer for investor sentiment and economic health. Recent fluctuations and market dynamics have raised questions among investors about the future trajectory of these markets, making it an important topic for anyone involved in finance or investing.

Current Market Trends

As of October 2023, the Dow Jones Industrial Average (DJIA) has experienced notable fluctuations. After peaking earlier in the year, reports show the index facing challenges primarily due to inflation concerns and shifts in Federal Reserve policy. Inflation rates, currently hovering around 3.7%, continue to raise eyebrows among economists, affecting consumer spending and business investments.

In recent weeks, technology shares have shown resilience, contributing positively to the DJIA. Companies like Apple and Microsoft have reported strong quarterly earnings, bolstering investor confidence. However, the ongoing geopolitical tensions, especially surrounding Eastern Europe, and supply chain issues stemming from the pandemic still loom large over the market.

Recent Events Impacting the Dow

One significant event impacting the Dow Jones recently was the announcement of interest rate modifications by the Federal Reserve. In a bid to combat inflation, the Fed signaled potential rate hikes in the forthcoming meetings, stirring both hope and concern among investors. Historically, rising interest rates can lead to market corrections; thus, traders are closely watching Fed comments for clues on the pacing of such changes.

Another factor is the tech sector’s regulatory scrutiny, particularly around antitrust laws. Companies that once drove the index’s growth are now facing potential headwinds from policymakers, which could affect their stock valuations. Market analysts suggest that investors should brace for volatility as these developments unfold.

Conclusion

In conclusion, the Dow Jones Stock Markets remain critical indicators of financial health and investor behavior amidst a rapidly changing economic landscape. With inflation concerns and Federal Reserve actions influencing market conditions, it is essential for potential investors to stay informed on these developments. Analysts forecast that as economic indicators evolve, the DJIA will continue to reflect the complexities of the broader market environment. As volatility persists, strategic investment and careful monitoring will be keys to navigating challenges in the upcoming quarters.