Understanding the Current Trends in RBC Stock Price

Introduction

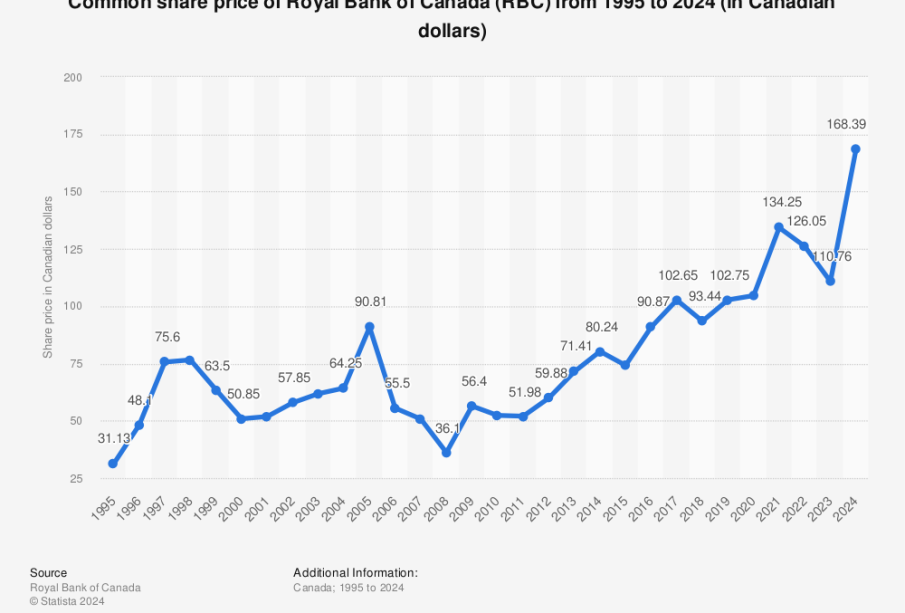

The Royal Bank of Canada (RBC) is one of the largest financial institutions in the country, and its stock price is a significant indicator of the health of the Canadian economy and the financial sector as a whole. As an investor, understanding the trends and current valuation of RBC’s stock price can guide informed decision-making amidst a fluctuating market. As of mid-October 2023, RBC’s stock price has shown considerable fluctuations amid various economic factors.

Current Stock Price and Market Performance

As of October 15, 2023, RBC shares are trading at approximately CAD 136.50, reflecting a year-to-date gain of about 12%. This increase comes despite a challenging economic backdrop characterized by rising interest rates and inflationary pressures that have impacted many financial institutions across Canada. Analysts suggest that RBC has adapted well to these conditions, maintaining a strong balance sheet and robust capital ratios, which continues to drive investor confidence.

Factors Influencing RBC Stock Price

Several critical factors influence the RBC stock price. First, the bank’s quarterly earnings reports play a crucial role, as they provide insights into its profitability, loan growth, and the performance of its various business segments. Most recently, RBC exceeded profit expectations by reporting net income of CAD 3.7 billion for the third quarter, driven by strong performance in Canadian banking and wealth management.

Another major influence is the broader economic environment, particularly the state of interest rates. Given that RBC earns a significant portion of its income from lending, higher interest rates can lead to increased margins. However, they can also dampen consumer spending and borrowing, presenting a mixed bag regarding long-term performance.

What Lies Ahead for RBC

Looking forward, investment analysts forecast that RBC’s stock price could continue to experience volatility as it navigates the complexities of the global economy. The consensus among financial analysts remains optimistic, with an average price target of CAD 150 by mid-2024. Factors such as advancements in digital banking and cost management initiatives are expected to position the bank favorably in an increasingly competitive marketplace.

Conclusion

In conclusion, RBC’s stock price remains a focal point for investors looking to understand the performance of the financial sector in Canada. The bank’s solid fundamentals, strategic initiatives, and resilient performance amid economic challenges highlight its potential for continued growth. Investors should keep a close eye on upcoming earnings releases and economic indicators that could further influence RBC’s stock trajectory in the coming months. Understanding these dynamics can empower investors to make well-informed decisions about their portfolios.