Understanding the Current Gold Price in India

Introduction

The gold price in India is a crucial marker for both consumers and investors, reflecting not just the value of the metal but also the country’s economic health. As one of the largest consumers of gold in the world, fluctuations in gold prices have far-reaching implications for India’s economy, impacting everything from investment strategies to the traditional jewelery market. Recently, there has been an uptick in gold prices, prompting discussions among experts about potential future trends.

Current Gold Prices

As of October 2023, the gold prices in India have reached an average of ₹5,500 per gram, a significant increase from the prices earlier this year, which hovered around ₹4,900 per gram. This change reflects a global trend where gold prices have surged due to various factors, ranging from geopolitical tensions to inflationary pressures. On international markets, gold has been trading at approximately $1,950 per ounce, further driving prices in India upward.

Factors Influencing Gold Prices

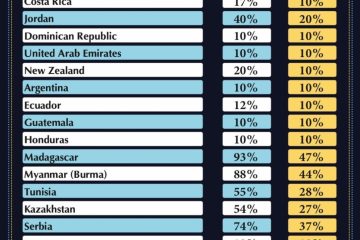

Several factors contribute to the current gold price in India. Geopolitical tensions, particularly in Central Asia and the Middle East, create uncertainty, leading investors to seek safety in gold. Additionally, the depreciating value of the Indian Rupee against the US Dollar makes imports of gold more expensive, directly influencing domestic prices.

Another critical factor is the rise in inflation rates. As inflation climbs, individuals and investors often turn to gold as a hedge against currency devaluation. The Reserve Bank of India’s recent comments regarding potential policy shifts have also added to the market’s volatility, further impacting gold demand.

Market Outlook

Market analysts predict that the gold price in India will remain volatile in the near term. Experts suggest that if geopolitical tensions continue and inflation rates persist, gold could see further price increases, potentially surpassing the ₹6,000 per gram mark. Conversely, if stability returns to the global markets and the Rupee strengthens, prices could drop.

Conclusion

The gold price in India is not just a reflection of intrinsic value; it also encapsulates the economic sentiment prevalent in the nation. For consumers, the increasing gold prices may prompt a shift in buying behaviors, while for investors, understanding these trends is key to making informed decisions. As the market evolves, staying informed about changes in both domestic and international landscapes will be essential for anyone involved in gold transactions.