Understanding the Current Dynamics of Costco Stock

Introduction

Costco Wholesale Corporation, a leading global retailer known for its warehouse club model, has become a focal point for investors due to its strong financial performance and market resilience. As of October 2023, the company’s stock is drawing significant attention amid fluctuating economic conditions and evolving consumer behaviors. Understanding the dynamics of Costco stock is crucial for investors interested in retail and consumer sectors.

Recent Performance

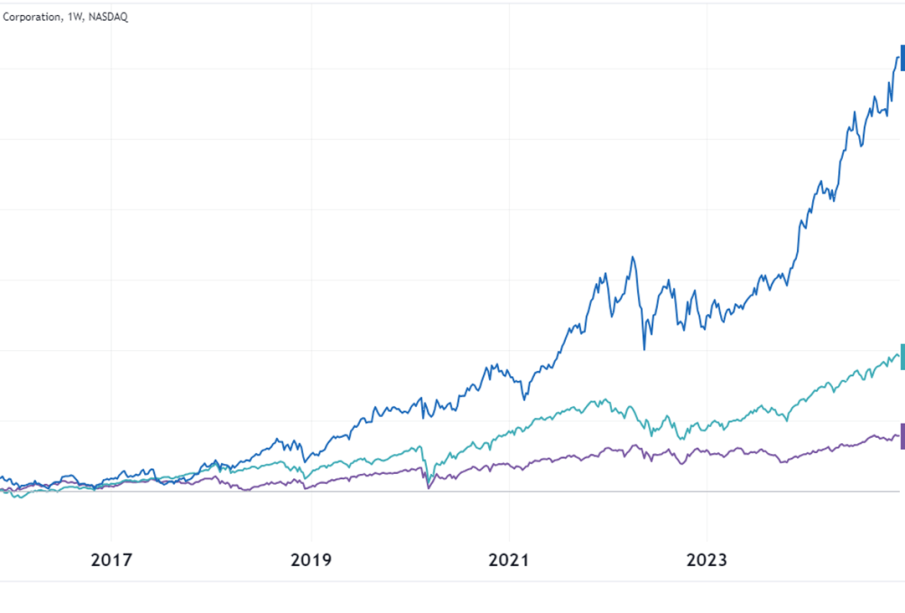

Costco’s stock (COST) has exhibited robust growth over the past few years, reflecting the company’s ability to adapt to market changes and expand its customer base. Despite recent market volatility affecting many retail stocks, Costco has managed to maintain a solid performance, with shares trading around $575, showing an approximate increase of 15% year-to-date.

The company’s latest earnings report, released earlier this month, demonstrated impressive revenue growth. Costco reported a revenue increase of 8% year-over-year, reaching $58 billion in its most recent quarter, driven primarily by strong membership renewals and increased sales per transaction. These figures highlight the company’s strong value proposition to its customers and its ability to attract and retain members.

Factors Influencing Costco Stock

Several factors have been influential in shaping Costco’s stock performance. First, the company’s effective supply chain management and strategic sourcing policies have allowed it to keep prices competitive, drawing in customers amid rising inflation.

Moreover, Costco’s commitment to e-commerce has expanded throughout the pandemic, further increasing convenience for shoppers. This shift has led to double-digit growth in online sales, contributing positively to overall revenue.

Additionally, analysts have pointed to Costco’s membership model as a significant advantage. With annual membership fees acting as a steady revenue stream, the company can leverage member loyalty to drive sales excess beyond just product pricing.

Conclusion

As investors look ahead, Costco stock appears well-positioned to navigate through potential economic challenges. Analysts project continued growth, anticipating that Costco will expand its footprint both domestically and internationally while solidifying its digital presence. With its resilient business model and strong customer loyalty, Costco remains a compelling option for investors. While market conditions may fluctuate, the fundamentals supporting Costco’s growth suggest that a long-term investment in the company could be beneficial. Potential investors should, however, stay updated on market trends and Costco’s performance metrics to make informed decisions.