Understanding the Current Canada Inflation Rate

Introduction

The inflation rate is a critical economic indicator that reflects the overall increase in prices for goods and services in an economy. In Canada, the inflation rate has been a key area of focus for policymakers, businesses, and consumers alike, especially in light of recent economic fluctuations. Understanding the current Canada inflation rate is essential for grasping the broader economic implications affecting everyday life.

Current Inflation Trends

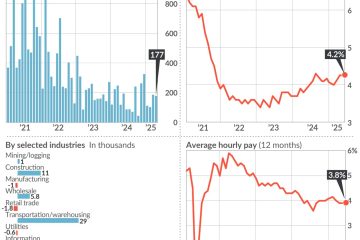

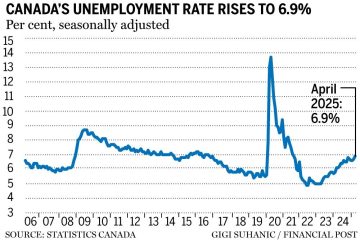

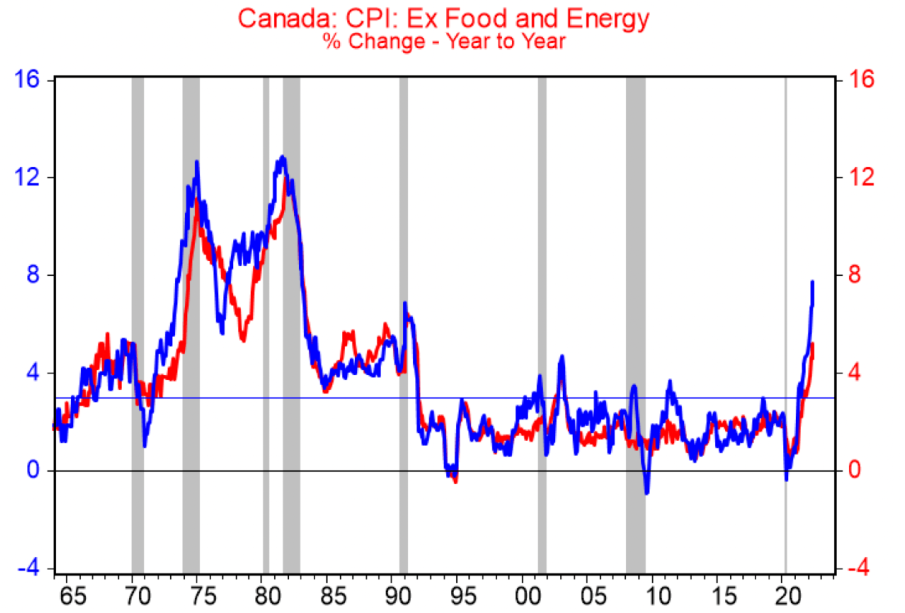

As of September 2023, Canada’s inflation rate stands at 4.0%, according to Statistics Canada. This figure represents a moderate decrease from previous months and suggests a gradual cooling of price increases that have affected various sectors. Food prices, for instance, have seen a year-over-year increase of 6.5%, while gas prices surged nearly 11% since last year. These numbers highlight the ongoing economic pressures consumers face.

Impact on the Economy

The rise in inflation has significant implications for the Canadian economy. Higher prices can erode purchasing power, making it difficult for households to maintain their standard of living. In response, the Bank of Canada has revised its monetary policy, including interest rate adjustments aimed at curbing inflation. The central bank raised interest rates several times over the past year to combat rising prices, which has led to increased borrowing costs for consumers and businesses.

Government Response

The Canadian government has introduced various measures to address inflation, including temporary relief programs and subsidies in essential sectors. Initiatives focusing on housing affordability and energy costs have been introduced to support citizens directly affected by the inflationary environment. Despite these efforts, economists warn that persistent inflation may require ongoing intervention from the government and the Bank of Canada.

Conclusion

The current Canada inflation rate remains a critical point of concern for many Canadians. While the recent decrease to 4.0% gives some hope, the challenges posed by rising costs—particularly in food and energy sectors—remain. Citizens should remain informed about economic developments as policymakers balance the need for action with the risks associated with tightening financial conditions. Going forward, monitoring the inflation trajectory will be vital for understanding its long-term implications on the Canadian economy and personal finances.