Understanding the Current Bank of Canada Interest Rates

Introduction

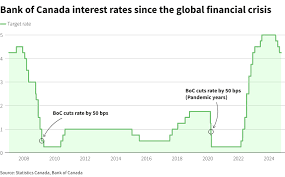

As Canada navigates through post-pandemic recovery, the subject of the Bank of Canada (BoC) interest rates has become paramount for both consumers and investors alike. The decisions made by the BoC regarding interest rates significantly impact borrowing costs, consumer spending, and inflation rates, shaping the economic landscape of the country. Monitoring these rates is essential for understanding the broader economic trends affecting households and businesses.

Current State of Interest Rates

As of October 2023, the Bank of Canada has maintained its key interest rate at 5.00%, following a series of increases throughout 2022 aimed at curbing persistent inflation. This decision reflects the ongoing challenge of maintaining price stability while promoting economic growth. The BoC’s target inflation rate is set at 2%, but recent data indicates inflation rates have hovered above this target, compelling the bank to adjust its monetary policy accordingly.

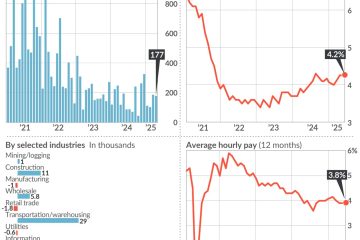

Economic Indicators and Forecasts

Recent reports have suggested that while inflationary pressures remain a concern, the Canadian economy is showing signs of resilience. Employment rates have improved, consumer spending has stabilized, and housing market activity has calmed following a period of rapid growth. Nonetheless, global factors including energy prices and supply chain disruptions continue to exert influence over the domestic economic situation.

Economists predict that interest rates may need to stay elevated for a few more months, but there are signs that a potential easing of rates could come into play in 2024 if inflation drops closer to the BoC’s target. The central bank has indicated a commitment to closely monitor economic data before making any changes to its current stance.

Implications for Canadians

For Canadians, the implications of the BoC’s interest rate decisions are far-reaching. Higher interest rates mean increased costs for borrowing, such as mortgages and personal loans, which can impact consumer spending and investment decisions. However, for savers, higher rates can provide better returns on savings accounts and fixed-income investments.

Conclusion

In summary, the Bank of Canada’s interest rates play a crucial role in the economic framework of the country. While current rates remain at a historically significant level, the evolving economic indicators suggest that the BoC is prepared to adapt its policy in response to changing conditions. For Canadians, staying informed about interest rate trends is essential for making well-rounded financial decisions.