Understanding the BTC to USD Exchange Rate and Its Importance

Introduction

The exchange rate between Bitcoin (BTC) and the US Dollar (USD) is a crucial indicator of not only the cryptocurrency market but also serves as a gauge of investor sentiment and economic trends. With Bitcoin being the most recognized cryptocurrency, understanding its fluctuations against the dollar provides essential insights for both investors and the public.

Recent Market Trends

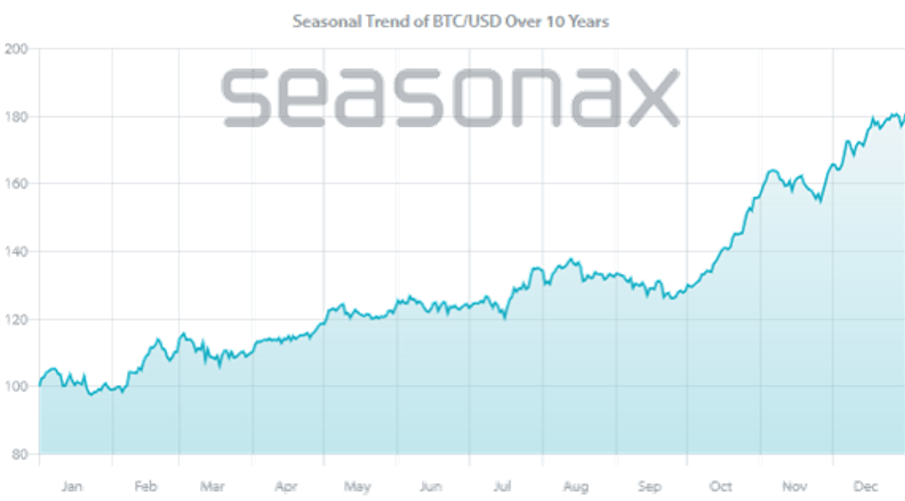

As of October 2023, Bitcoin has seen significant volatility in its price, heavily influenced by various macroeconomic factors including inflation rates, regulatory developments, and overall market sentiment towards digital currencies. The BTC to USD exchange rate recently fluctuated between $26,000 and $32,000, reflecting its characteristic erratic nature.

In early October, Bitcoin’s price witnessing a surge was attributed to increasing institutional interest, especially with major companies beginning to accept BTC as a form of payment. Analysts reported that this move is bolstered by a more supportive regulatory environment in some regions, suggesting that Bitcoin may be gaining traction as a legitimate asset class.

Influencing Factors

Several factors influence the BTC to USD exchange rate:

- Regulatory Developments: Governments worldwide are increasingly clarifying their stance on cryptocurrencies, which directly impacts investor confidence.

- Market Sentiment: News events and public sentiment, often driven by social media trends, can lead to sudden spikes or drops in Bitcoin’s price.

- Technological Developments: Upgrades and enhancements in the Bitcoin network, such as the Taproot upgrade, may improve transaction efficiency and security, affecting its value.

Conclusion

As Bitcoin evolves and matures, its relationship with the USD becomes increasingly intricate. Investors must keep an eye on emerging trends and market signals to make informed decisions. The BTC to USD rate not only reflects Bitcoin’s market performance but also offers insights into broader economic conditions and the future of digital currencies. With predictions estimating Bitcoin could range from $30,000 to $50,000 by the end of 2023, potential investors should carefully consider market analysis and regulatory news that can sway these projections.