Understanding the Bank of Canada Interest Rate Changes

Introduction

The Bank of Canada (BoC) plays a crucial role in the nation’s economic health through its monetary policy, most notably by setting interest rates. This topic has garnered significant attention, especially as Canadians navigate rising living costs and changing economic conditions. With inflation being a critical concern, understanding the BoC’s interest rate decisions is essential for consumers, businesses, and investors alike.

Recent Developments

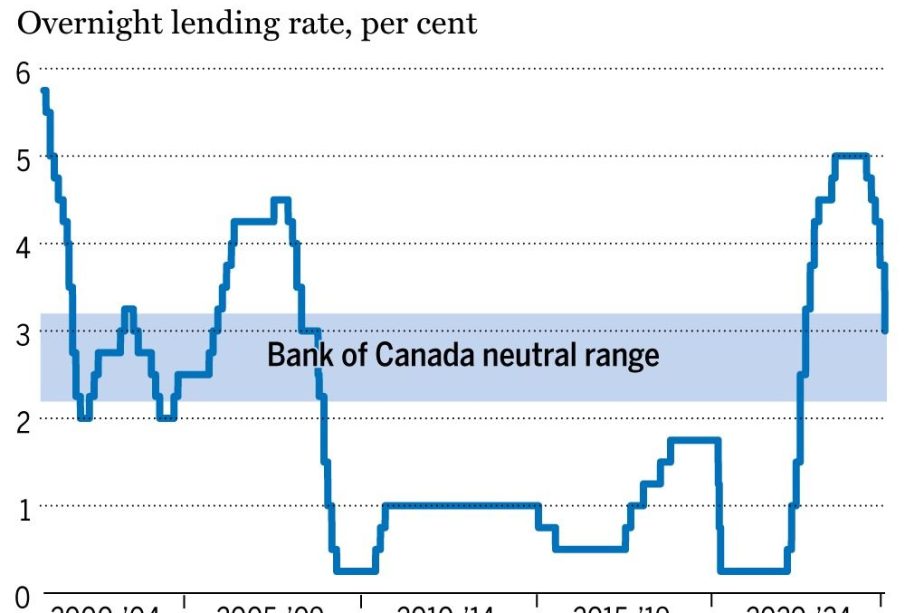

On September 6, 2023, the Bank of Canada announced its decision to maintain the overnight interest rate at 5.00%, the highest level since 2001. This decision comes in the wake of persistent inflationary pressures, which the central bank aims to control through its monetary policies. The BoC stated that inflation remains above its 2% target and that it is committed to bringing it back to this target sustainably.

Internationally, economic uncertainties, particularly concerning geopolitical issues and supply chain disruptions, continue to evolve. In response, the BoC has expressed a cautious approach, emphasizing its readiness to increase rates further if inflation does not show signs of moderation. Such shifts in rates have considerable implications for the economy, affecting everything from mortgage rates to consumer spending.

Impact on Canadians

The decision to hold interest rates at a high level impacts various sectors of the economy. Canadians with variable-rate mortgages or loans face higher repayment costs, which can lead to financial strain. Conversely, those with savings accounts may benefit from higher interest earnings. The housing market shows signs of cooling as potential buyers reconsider affordability in light of rising interest rates.

Moreover, businesses are reassessing their investment plans. Higher borrowing costs may discourage expansion projects and slow economic growth, prompting concerns over job creation and wage growth. As a result, some economists warn of a potential recession if consumer and business confidence continues to wane.

Looking Ahead

As we move forward, economists and market analysts will be closely monitoring the Bank of Canada’s next steps. The next scheduled rate announcement is set for October 25, 2023, where market participants expect the central bank to either hold the current rate or potentially adjust it according to evolving economic conditions and inflation trends.

In conclusion, the Bank of Canada’s interest rate policies are pivotal not only for economic stability but also for the everyday lives of Canadians. By staying informed on these updates, individuals and businesses can better prepare for financial implications while navigating the current economic landscape.