Understanding the Bank of Canada Interest Rate Changes

Introduction

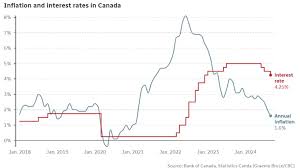

The Bank of Canada interest rate is a critical tool used by the central bank to influence the Canadian economy. As inflation remains a persistent concern, understanding the decisions made by the Bank can help Canadians navigate their financial futures. Recent adjustments to the interest rate have had significant repercussions across various sectors, including housing, investment, and consumer spending.

Recent Developments

On September 6, 2023, the Bank of Canada announced a maintained interest rate of 5.00%, marking a pause in their campaign of rate hikes that began in early 2022. The decision followed a series of increases aimed at combating rising inflation, which peaked at 8.1% in June 2022, the highest level recorded in decades. Since then, inflation has shown signs of stabilization, falling to around 3.3% in July 2023, but remains above the target rate of 2%.

Governor Tiff Macklem emphasized the importance of observing inflation trends and economic data before proceeding with any further adjustments. Analysts from various financial institutions suggest that the central bank is likely to maintain a cautious approach moving forward, keeping the interest rate steady through the remainder of 2023 but reassessing as new data becomes available.

Impact of the Interest Rate on Canadians

The interest rate set by the Bank of Canada influences borrowing costs for Canadians. A higher interest rate makes borrowing more expensive, impacting mortgages, personal loans, and credit cards, which in turn affects consumer spending and investment decisions. With housing affordability already squeezed in many urban centers, the maintained rate may provide some relief to potential home buyers who are navigating a challenging market.

Conversely, savers may find higher interest rates beneficial as they can expect better returns on savings accounts and fixed-term deposits. The ongoing impact, however, means that households must remain vigilant about their financial health as economic conditions fluctuate.

Conclusion

The Bank of Canada’s interest rate plays a pivotal role in shaping the economic landscape of the nation. With the current trend of stability, Canadians remain hopeful that further economic signals will guide the Bank’s future decisions. As inflation persists as a primary concern, the Bank’s actions will continue to influence various aspects of daily life—from mortgage rates to investment opportunities. Looking ahead, careful monitoring of economic data will be crucial for individuals and businesses as they plan for their financial futures amidst ongoing uncertainties.