Understanding TD Stock Price Trends: Insights and Forecasts

Introduction

The stock price of Toronto-Dominion Bank (TD) is a significant indicator of the bank’s financial health and market sentiment. As one of Canada’s largest banks, TD plays a critical role in the North American economy. Investors and analysts closely monitor its stock price for insights into the bank’s performance, making it a topic of considerable interest for shareholders and potential investors alike.

Recent Trends in TD Stock Price

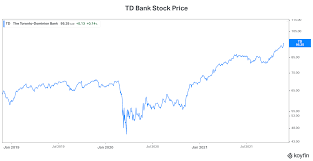

As of late October 2023, TD’s stock price has demonstrated notable fluctuations largely due to various economic factors, including interest rate changes, inflation rates, and overall market conditions. Recently, TD’s stock price was observed to be trading around CAD 89.50, reflecting a slight decrease from its peak earlier in the year.

Analysts have attributed this decline to the Bank of Canada’s recent interest rate hikes, which have impacted the entire banking sector. Higher interest rates typically result in increased borrowing costs, which can slow down loan growth and, in turn, affect banks’ profitability. However, experts remain optimistic, forecasting a rebound as bank earnings reports suggest strong financial resilience.

Key Factors Influencing TD Stock Price

Several key factors are currently influencing TD’s stock price:

- Interest Rates: The monetary policies of the Bank of Canada continue to shape investor expectations about bank earnings, particularly in lending.

- Economic Indicators: Metrics such as unemployment rates and GDP growth are vital. Recent economic data suggests a stable economy, which could bolster TD’s performance.

- Mergers and Acquisitions: TD’s planned acquisition of First Horizon Bank, which is expected to close in the coming months, has generated investor enthusiasm and may positively impact its stock price.

- Global Market Conditions: Fluctuations in the U.S. and global markets also have a direct impact on TD, given its substantial presence in both Canada and the United States.

Conclusion and Future Outlook

In summary, while TD’s stock price has faced recent downward pressure, various factors indicate a potential for recovery. Investors should monitor economic indicators and corporate earnings closely as they can significantly influence future performance. With anticipated growth from strategic acquisitions and potential stabilization in interest rates, TD stock price forecasts remain cautiously optimistic for the months ahead. This presents an opportunity for investors willing to navigate the current market fluctuations and capitalize on potential growth.