Understanding TD Bank Stock: Trends and Predictions

Introduction to TD Bank Stock

TD Bank, or Toronto-Dominion Bank, is one of Canada’s largest financial institutions, with a growing presence in the United States. The performance of TD Bank stock is significant not only for investors but also for the overall economy, as banks are often viewed as indicators of financial health. In recent months, several factors have influenced the stock price and investor sentiment, making this an important topic for both casual observers and dedicated investors.

Recent Performance and Market Trends

As of October 2023, TD Bank stock has shown a notable performance fluctuation driven by various market conditions. In the first half of the year, the stock saw a commendable rise, reflecting the bank’s robust earnings, primarily resulting from increased interest rates which boosted net interest margins. However, since mid-September, the stock has faced pressure due to global economic uncertainties, heightened inflation concerns, and a potential recession on the horizon.

Furthermore, TD Bank’s recent quarterly reports have revealed a mixed outlook. The Q3 2023 earnings report indicated a year-over-year revenue increase, attributed to strong performance across its Canadian and U.S. divisions, particularly in consumer banking and wealth management. Nonetheless, increased provisions for credit losses raised some investor eyebrows, signaling caution amidst an unpredictable economic landscape.

Comparative Analysis and Investor Sentiment

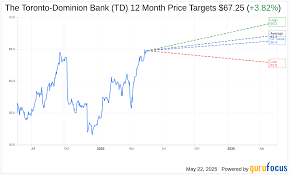

When compared to other major Canadian banks such as Royal Bank of Canada and Scotiabank, TD Bank stock has performed relatively similarly. However, investor sentiment seems to hinge on its management’s ability to navigate upcoming challenges, including regulatory changes and potential credit risk as interest rates stabilize. Analysts forecast that TD Bank stock may face volatility in the near future but can regain momentum in the long term if it effectively manages these risks.

Conclusion: Looking Ahead

As we approach the end of 2023, the outlook for TD Bank stock will heavily depend on the bank’s ability to adapt to economic shifts and maintain profitability amidst headwinds. Investors are advised to stay informed about the bank’s strategic initiatives, regulatory changes, and market developments. While some analysts maintain a positive outlook on TD Bank stock due to its strong fundamentals, others caution that external factors could lead to continued volatility. Overall, it’s crucial for current and potential investors to keep a close eye on the evolving landscape surrounding TD Bank as they make informed decisions.