Understanding S&P 500 Futures and Their Market Impact

Introduction

S&P 500 futures are an essential component of the financial markets, providing investors with the opportunity to speculate on the future performance of the stock market. These futures contracts reflect the value of the S&P 500 index, which is a benchmark of the largest publicly-traded companies in the United States. As markets evolve, S&P 500 futures are increasingly relevant as indicators of market sentiment and performance expectations.

Current Market Trends

As of October 2023, S&P 500 futures have demonstrated significant fluctuations reflecting broader economic conditions. Following a period of robust corporate earnings, futures began showing bullish trends, suggesting confidence among investors. Recent reports indicate that the futures have stabilized around high levels due to optimistic forecasts for ongoing economic recovery and an easing of inflation pressures.

On the other hand, concerns over interest rate hikes have created some volatility in futures trading. The Federal Reserve’s ongoing discussions around monetary policy adjustments have made futures contracts a valuable tool for hedging against potential market corrections. As of now, the S&P 500 futures are trading cautiously as investors await clearer signals from economic data releases and Fed policies.

Investment Strategies Involving Futures

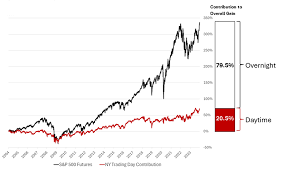

For investors considering involvement in S&P 500 futures, several strategies can be adopted to manage risk and enhance returns. Day trading, for instance, allows for capitalizing on short-term market movements while holding positions through trading sessions. Alternatively, hedging positions via futures can protect against downturns in stock portfolios, making this tool vital for both institutional and retail investors.

Conclusions and Outlook

In summary, S&P 500 futures are a barometer of investor sentiment and an essential tool for portfolio management and speculation. The current market environment reflects a complex interplay of growth expectations and caution stemming from interest rate policies. As companies prepare to release quarterly earnings and economic indicators begin to roll in, it is vital for investors to monitor S&P 500 futures closely as they will continue to offer insights into market direction.

As the end of 2023 approaches, analysts anticipate continued volatility but remain optimistic about long-term growth potential, particularly if inflation stabilizes further. The S&P 500 futures will likely remain pivotal in informing investor decisions and strategies, and keeping abreast of these trends will be essential for navigating the future landscape of financial markets.