Understanding Scott Bessent’s Impact on Investment Strategies

Introduction

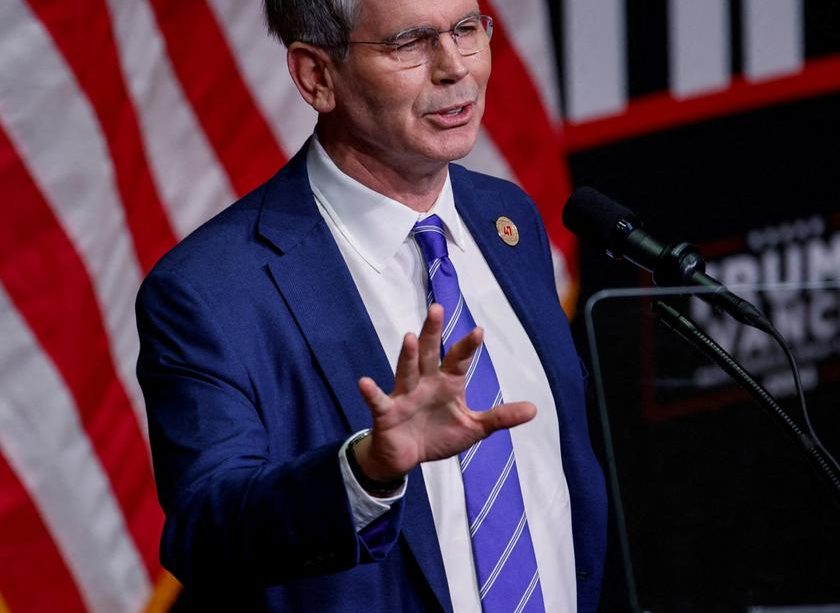

Scott Bessent, the Chief Investment Officer of key firms and a former executive at George Soros’ Quantum Fund, has made waves in the finance industry with his insightful investment strategies. Amidst the volatility in global markets due to economic uncertainties and geopolitical tensions, his strategies have drawn increasing attention from both investors and analysts. Understanding Bessent’s methodologies provides valuable insights relevant not only for seasoned investors but also for discerning newcomers navigating the complex world of finance.

Recent Developments in Bessent’s Strategies

In recent interviews, Bessent has emphasized the importance of adapting to the fast-changing market environment. He pointed to inflationary pressures, interest rate hikes, and supply chain issues resulting from the COVID-19 pandemic as factors influencing his investment outlook. Bessent advocates for a diversified investment approach. He highlights sectors like technology that show resilience amid economic turmoil but also promotes investments in sustainable and responsible businesses for long-term growth.

Moreover, in a recent conference about market predictions, Bessent shared his foresight on the growing significance of ESG (Environmental, Social, and Governance) investments, indicating that such criteria will likely play an essential role in tomorrow’s investment landscape. His focus on incorporating these values aligns with a broader shift within financial markets where investors are increasingly considering both profits and societal impact.

Looking Ahead

As the market continues to evolve, Scott Bessent’s insights represent a robust compass for navigating potential pitfalls and opportunities. His emphasis on careful evaluation and diverse portfolio positioning may not only protect investors during downturns but also leverage growth in emerging markets, particularly in technology and sustainable investments. With his established track record and forward-thinking mindset, Bessent is poised to influence investment strategies effectively in 2023 and beyond.

Conclusion

Scott Bessent’s approach to investment emphasizes the importance of adaptability and foresight in a fluctuating market. As investors worldwide face challenges posed by inflation and other economic factors, Bessent’s methodologies serve as a guide for finding resilience and potential growth. For retail and institutional investors alike, staying updated with insights from financial leaders like Bessent is vital for making informed decisions and navigating the complexities of modern investing.