Understanding Scott Bessent’s Impact on Global Financial Markets

Introduction

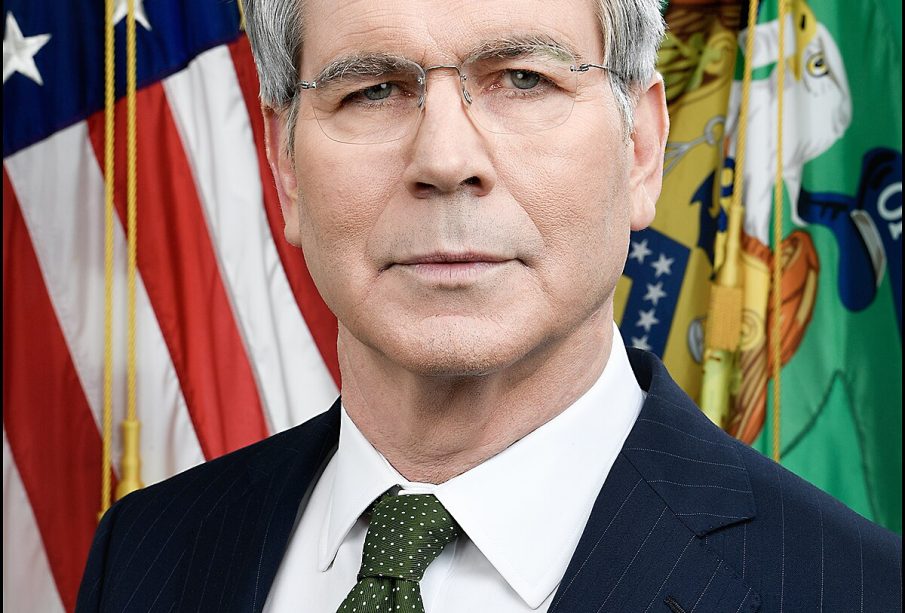

In the ever-evolving landscape of global finance, few individuals have made as significant an impact as Scott Bessent. A seasoned investor and thought leader, Bessent’s insights into market strategies and economic trends are invaluable for both seasoned professionals and novices alike. His career spans decades, with pivotal roles in some of the world’s leading investment firms, making his opinions highly relevant in today’s fluctuating market conditions.

Scott Bessent: A Brief Overview

Scott Bessent is best known as the former Chief Investment Officer (CIO) of George Soros’ investment firm, Soros Fund Management. With a robust educational background from reputable institutions, he has honed his expertise in global macroeconomic trends and investment strategies. After leaving Soros in 2015, Bessent founded Key Square Group, a hedge fund that focuses on global macro-investing, a strategy that has tied closely to his philosophy that markets are driven by a complex interplay of economic, political, and social factors.

Current Market Insights

As of 2023, Bessent has been vocal about his perspectives on current market trends. Amidst rising inflation and geopolitical uncertainties, he stresses the importance of being adaptable and informed. During a recent financial conference, he highlighted emerging markets as potential areas for growth, particularly in sectors that show resilience against economic downturns. Bessent’s analyses indicate a cautious optimism as investors navigate through challenges posed by monetary policy adjustments and global instability.

Bessent has also been bullish on technology-driven innovations, suggesting that sectors such as renewable energy and cybersecurity are positioned to thrive in the coming years. His advocacy for sustainable investment practices aligns with a growing movement among investors seeking long-term value while addressing climate change.

Conclusion

Scott Bessent remains a pivotal figure in the global investment landscape, with insights that empower investors to make informed decisions in uncertain times. His emphasis on adaptability, thorough research, and awareness of macroeconomic indicators is crucial as individuals and institutions face a rapidly changing economic environment. Looking ahead, Bessent’s perspectives will undoubtedly continue to shape investment strategies, providing valuable lessons for navigating the complexities of global markets. For readers and investors, staying attuned to Bessent’s insights may be the key to seizing opportunities in this dynamic financial era.