Understanding SBUX Stock Performance and Market Trends

Introduction

Starbucks Corporation, the globally recognized coffee giant, is listed on NASDAQ under the ticker symbol SBUX. As the company continues to expand its footprint and embrace innovative strategies, monitoring its stock performance becomes crucial for investors and market observers. In recent months, SBUX stock has shown both resilience and volatility, making it a focal point for those tracking the consumer discretionary sector.

Current Market Performance

As of October 2023, SBUX stock is priced at approximately $110 per share, reflecting an increase of 15% since the beginning of the year. The uptick in share price can largely be attributed to the company’s strategic initiatives, including an aggressive expansion plan in international markets, notably Asia, where demand for premium coffee is on the rise.

Additionally, Starbucks has reported robust quarterly earnings, exceeding analysts’ expectations. In its latest earnings report, the company disclosed revenue of $8 billion, driven by both strong same-store sales and digital channel growth. The company’s commitment to sustainability and ethical sourcing has also resonated well with environmentally conscious consumers, further stockpiling customer loyalty.

Market Challenges

Despite the positive trend, SBUX is not without its challenges. The ongoing pressures of inflation and rising labor costs have forced the company to reevaluate its pricing strategies. Some analysts have expressed concerns about how price adjustments might alter consumer behavior in the long term. Furthermore, the threat of economic downturns looms, with potential impacts on discretionary spending that could affect sales.

Future Outlook

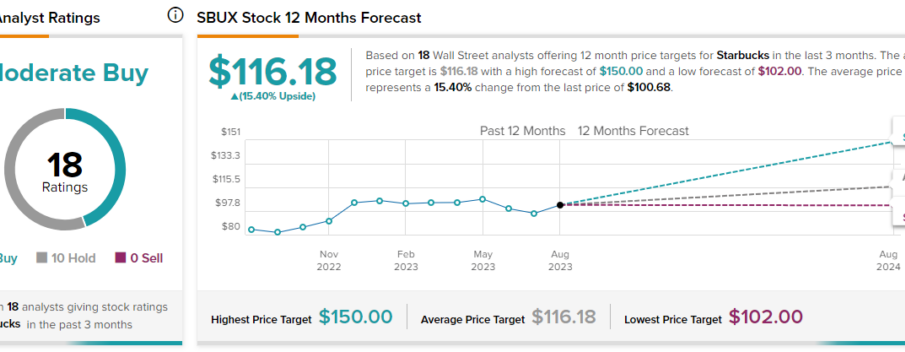

Looking ahead, analysts remain bullish on SBUX stock, predicting price targets ranging from $120 to $130 over the next 12 months. The growth in digital innovation, including increased investments in mobile ordering and delivery services, is expected to further bolster sales. Additionally, Starbucks’ commitment to expanding its loyalty program could enhance customer retention, too.

Conclusion

In conclusion, SBUX stock represents a compelling opportunity for both seasoned investors and those newly entering the market. While challenges remain, particularly related to economic conditions and pricing pressures, the company’s strategic growth initiatives and solid performance make it a noteworthy player in the market. Investors are advised to remain vigilant and consider both the risks and rewards associated with trading SBUX stock as they make informed decisions going into 2024.