Understanding RY Stock: Trends and Insights

Introduction to RY Stock

RY stock, representing Royal Bank of Canada (RBC), one of the country’s largest financial institutions, has gained significant attention among investors. RBC provides a range of financial services including personal and commercial banking, wealth management, and insurance. The importance of monitoring RY stock lies in its direct impact on the Canadian economy and its role as a barometer for the banking sector. With recent fluctuations in the stock market, understanding the driving factors behind RY stock’s performance has become vital for both current investors and market observers.

Recent Developments in RY Stock

As of late October 2023, RY stock has shown resilience despite broader economic challenges. The stock recently traded at approximately CAD 131, reflecting a year-to-date performance that has outpaced many of its competitors. Several factors have contributed to this positive trend. Firstly, RBC reported strong quarterly earnings, driven by a robust increase in net interest income, illustrating the strength of its retail banking segment.

Additionally, RBC’s strategic expansion into digital banking has attracted younger clients, further diversifying its revenue streams. These developments come at a time when traditional banking faces challenges from fintech startups, making RBC’s adaptability crucial in maintaining its competitive edge.

Market Analysis and Predictions

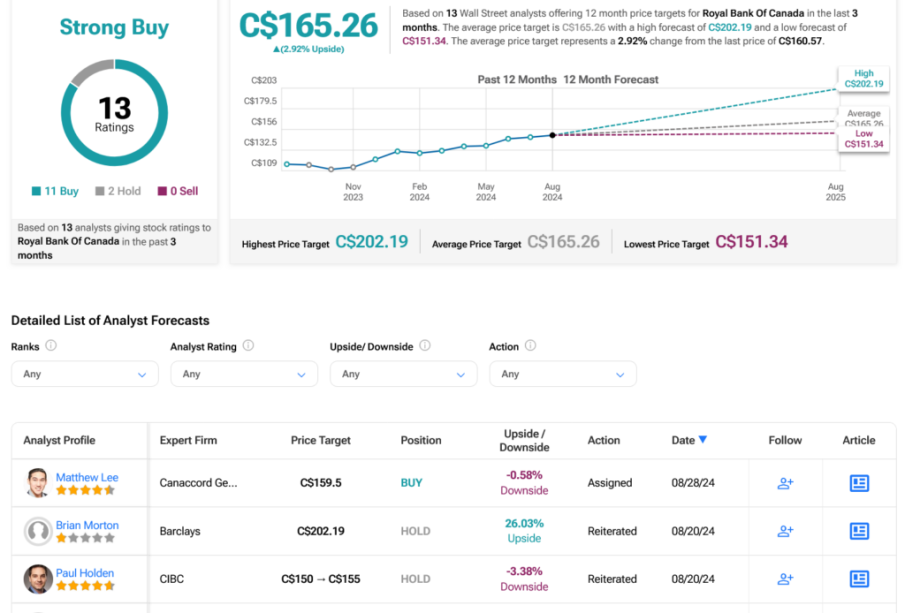

Analysts generally have a positive outlook on RY stock, particularly noting its dividend yield of around 4.2%, which appeals to income-focused investors. Furthermore, experts predict that the ongoing increase in interest rates will enhance RBC’s profitability, as higher rates typically lead to wider margins on loans. However, challenges remain, including potential economic downturns and regulatory changes that could impact lending practices.

Conclusion

In conclusion, RY stock represents a significant investment opportunity within the Canadian stock market, backed by strong fundamentals and a commitment to innovation. Its recent performance underscores the resilience of RBC as it navigates through a complex financial landscape. Investors looking for stability and growth should keep a close watch on RY stock as it continues to adapt to changing market dynamics. With the banking sector expected to remain in the spotlight, RY stock remains a key player to consider for a diversified portfolio.