Understanding RBC Stock: Trends and Market Insights

Introduction

RBC Stock, representing the Royal Bank of Canada, is one of the largest financial institutions in the country and a significant player in the global banking sector. Understanding its stock performance is crucial for investors, analysts, and anyone monitoring the financial market trends. As Canada’s largest bank by market capitalization, RBC offers insights into the broader economic landscape and banking sector’s health, making it a vital component of investment portfolios.

Recent Performance

As of October 2023, RBC’s stock has shown resilience amidst varying economic conditions. The stock price has seen an increase of approximately 5% over the past three months, driven by robust quarterly earnings reports that exceeded market expectations. In its most recent quarterly report, RBC reported a net income of $3.7 billion, up 4% year over year, bolstered by strong performance in its personal and commercial banking divisions. This performance has positively influenced investor confidence, reflected in the upward trajectory of its stock price.

Market Factors Influencing RBC Stock

Several factors influence RBC’s stock performance, including interest rates, economic growth, and the bank’s strategic initiatives. The Bank of Canada’s recent monetary policy adjustments, especially concerning interest rates, have a direct impact on bank profitability. A stable interest rate environment is generally favorable for banking institutions, allowing them to maintain healthy profit margins on loans and other financial products.

Furthermore, economic conditions in Canada, including consumer spending and housing market trends, significantly affect RBC’s performance. Despite some economic uncertainty, RBC has strategically invested in technology and digital banking to enhance customer experience and operational efficiency, contributing to its sustained growth.

Investment Outlook

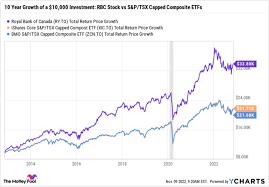

Analysts remain cautiously optimistic about RBC Stock. The current price-to-earnings ratio suggests that the stock is fairly valued, but with potential for growth, especially if the Canadian economy continues to show signs of recovery. Financial analysts recommend RBC as a strong buy for investors seeking stability and dividends, given its consistent dividend payout history and robust capital management strategy.

Conclusion

In summary, RBC Stock plays a significant role in the Canadian financial market, reflecting the health of both the banking sector and the economy as a whole. Investors looking to benefit from stable returns and capitalize on growth opportunities should keep a close eye on RBC’s performance and adjustments in economic conditions. With its strong fundamentals and strategic initiatives, RBC presents a promising opportunity for seasoned and new investors alike.