Understanding RBC Stock: Recent Trends and Future Outlook

Introduction to RBC Stock

The Royal Bank of Canada (RBC) is one of the largest financial institutions in Canada, making its stock a subject of interest for investors both domestically and internationally. As of October 2023, RBC stock has shown significant activity influenced by various economic factors, including interest rates and market trends.

Current Performance

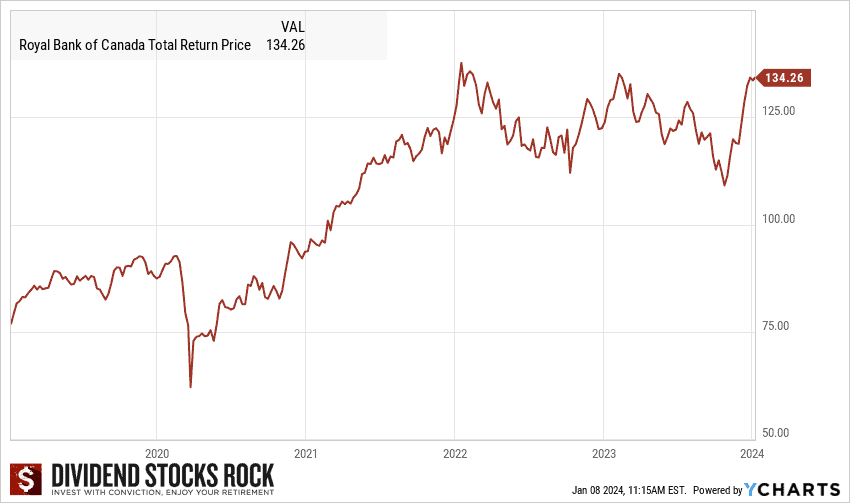

As of the latest trading session, RBC stock has been fluctuating between CAD 125 and CAD 130 per share. Recent reports indicate an upward trajectory largely attributed to positive earnings results released earlier this month. RBC reported a 10% increase in its quarterly earnings, driven by a robust performance in its wealth management and personal banking segments.

Investors have shown optimism following these positive results, noting that RBC’s diversified business model helps cushion the impact of economic downturns. Additionally, analysts have rated the stock as ‘buy’ based on its solid fundamentals and potential for growth as Canada’s economy rebounds post-pandemic.

Factors Influencing RBC Stock

Several key factors are influencing RBC stock performance:

- Interest Rates: Rising interest rates generally benefit banks by increasing their net interest margins. The Bank of Canada has hinted at further rate hikes, which could continue to boost RBC’s profitability.

- Economic Environment: Canada’s economic recovery is in full swing with increased consumer spending and business investments, which augur well for RBC’s lending operations.

- Regulatory Changes: Changes in financial regulations can impact RBC’s operational flexibility and profits, making it a critical area for investors to monitor.

Future Outlook

Looking ahead, analysts predict that RBC stock will continue to perform well, with price targets set around CAD 135 to CAD 140 in the upcoming quarters. Much of this optimism relies on sustained economic growth, effective management of loan provisions, and expansion into U.S. markets, where RBC has been enhancing its presence.

Conclusion

In summary, RBC stock presents a compelling case for both current and prospective investors. With solid earnings, growth prospects bolstered by economic recovery, and a growing footprint in the U.S., RBC remains a key player in the Canadian financial sector. Investors should keep a close watch on industry developments and economic indicators that could affect RBC’s performance in the near future.