Understanding RBC Stock Performance and Future Outlook

Introduction

Royal Bank of Canada (RBC) is one of the largest financial institutions in Canada, and its stock, listed on the Toronto Stock Exchange as RY, is a vital indicator of the overall health of the Canadian banking sector. With its substantial market capitalization and influential presence in both domestic and international markets, the performance of RBC stock is crucial for investors and stakeholders. Recent economic landscapes have added layers of complexity to RBC’s stock movements, making it essential to analyze current trends and forecasts.

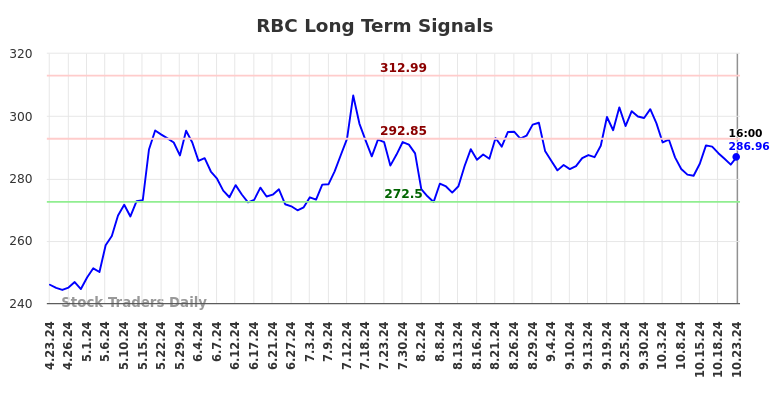

Current Performance

As of early October 2023, RBC stock has shown resilience despite ongoing economic challenges including inflationary pressures, rising interest rates, and cautious spending behaviors among consumers. The stock is trading at approximately CAD 132.50, reflecting a slight decrease of around 2% over the past month, influenced by broader market volatility. Analysts attribute this dip to investor apprehensions regarding potential economic slowdowns impacting banks’ profit margins.

Financial Results and Market Sentiment

In its latest quarterly earnings report for Q3 2023, RBC reported a net income of CAD 4.3 billion, a 5% increase compared to the previous year. The bank benefited from a rise in interest income, attributed to higher interest rates on loans and mortgages. Moreover, RBC has demonstrated strength in its wealth management and capital markets segments. Nevertheless, potential increases in loan defaults amid rising lending rates continue to weigh on investor sentiment.

Future Outlook

Experts project cautious optimism for RBC stock moving into the next quarter. Financial analysts recommend that long-term investors consider the strong fundamentals of the bank, including its diversified revenue streams and robust capital position. However, they also advise monitoring macroeconomic indicators that could impact the banking sector’s performance, including consumer credit trends and central bank policies.

Conclusion

RBC stock remains a key barometer for the Canadian banking industry’s health and the broader economy. While current challenges may loom over short-term performance, RBC’s solid foundation and historical resilience present significant opportunities for investors. As market conditions evolve, stakeholders should stay informed and ready to adapt their strategies accordingly, considering both the inherent risks and potential rewards associated with investing in RBC stock.