Understanding RBC Banking Relationship Termination

Introduction

The termination of a banking relationship can significantly impact customers, affecting their financial transactions, credit ratings, and future banking opportunities. Recently, RBC (Royal Bank of Canada) has become a focal point for discussions pertaining to banking relationship terminations. This development is pertinent as it highlights the growing complexities involved in banking services and customer satisfaction in Canada.

Details Surrounding RBC’s Future Trends

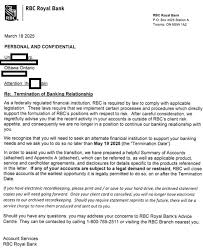

RBC, one of Canada’s leading financial institutions, has recently revised its customer engagement strategies. Due to a mix of economic pressures and regulatory changes, some customers have reported challenges with maintaining their banking relationship with RBC. In several cases, clients have experienced sudden account closures or terminations without adequate notice or explanation.

Industry analysts suggest that these terminations may stem from various factors including inactive accounts, potential financial risks, or non-compliance with RBC’s service agreements. Throughout the last quarter, RBC has made attempts to improve their operational processes to ensure better customer communication and retention.

Customer Experiences and Implications

Those individuals affected by RBC’s decision to terminate relationships have expressed frustration regarding the lack of clarity and support. A survey conducted in October 2023 indicated that up to 25% of RBC customers are unaware of the reasons behind account closures. This lack of transparency raises concerns over how banking institutions communicate with clients and manage their accounts.

Moreover, for individuals and businesses who find their banking relationship terminated, navigating the aftermath can be challenging. It can affect access to credit, impact the ability to obtain loans, and create barriers to opening new accounts with different banks. Clients are advised to seek clarity on their banking status, as well as explore consultation with financial advisors to mitigate negative consequences.

Conclusion

The termination of banking relationships, as seen with RBC, sheds light on the significant need for improved customer interaction and support within the banking industry. As these trends develop, it is crucial for customers to stay informed and proactive about their financial standings. Being aware of how banking policies may change and understanding the rights of consumers could help mitigate the risks associated with unexpected account closures. It remains to be seen how RBC and other financial institutions will adjust their practices in response to customer feedback and the evolving financial landscape.