Understanding Qubt Stock: Performance and Trends

Introduction

The stock market can be a complex landscape, but understanding individual stocks such as Qubt (Qubit, Inc.) is crucial for investors looking to make informed decisions. As a technology-focused company specializing in quantum computing solutions, Qubt has garnered significant attention in recent months due to its innovative approaches and market potential. With advancements in quantum technologies becoming a focal point of global scientific and economic discussions, Qubt’s stock performance is of considerable importance to both investors and technology enthusiasts.

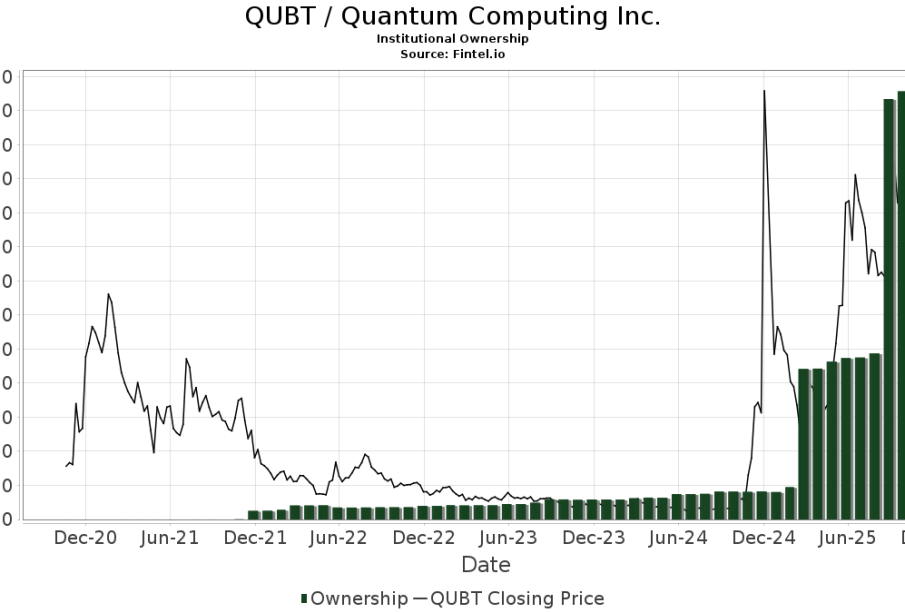

Recent Performance

In the past quarter, Qubt stock has experienced notable fluctuations. As of late October 2023, the stock was trading at approximately CAD 15.75, reflecting a change of around 12% from the previous month. Analysts have pointed to several factors influencing this performance, including new project announcements, collaborations with leading tech firms, and increasing investor interest in quantum technologies.

Qubt’s recent partnership with a major multinational technology corporation to enhance quantum computing applications in financial services has sparked optimism among investors. This collaboration aims to optimize data processing speeds and enhance security protocols. With the global market for quantum computing projected to grow exponentially over the next decade, companies like Qubt are poised for significant growth.

Market Sentiment and Expert Opinions

Market analysts have shown a mixed but generally positive sentiment towards Qubt. Some experts predict that the stock could rise further if the company continues its pace of innovation and successful collaboration. A recent report from a leading financial advisory service expressed confidence in Qubt’s long-term potential, citing their innovative technologies and increasing patents as key indicators of future success.

However, the volatility in the tech sector, coupled with global economic uncertainties, has led some investors to exercise caution. It’s important for potential investors to consider both the opportunities and risks associated with Qubt’s stock, engaging in thorough research and seeking professional advice when necessary.

Conclusion

With the burgeoning interest in quantum computing, Qubt stands at the forefront of a rapidly evolving market. As the company continues to drive innovation and forge strategic collaborations, its stock performance will remain a focal point for investors looking to capitalize on the future of technology. For readers interested in the dynamics of the stock market, especially in the context of groundbreaking technologies, understanding the factors influencing Qubt’s stock could inform investment strategies and decisions moving forward.