Understanding QQQ Stock: Trends and Market Implications

Introduction

QQQ stock, which tracks the Nasdaq-100 Index, has become a focal point for investors looking to tap into the technology-driven market.

Current Trends in QQQ Stock

As of October 2023, QQQ stock has shown considerable volatility, reflecting the broader market’s response to economic indicators and interest rate changes. The technology sector, which drives a significant portion of the QQQ, has been pivotal, with companies like Apple, Microsoft, and Amazon contributing to its fluctuations.

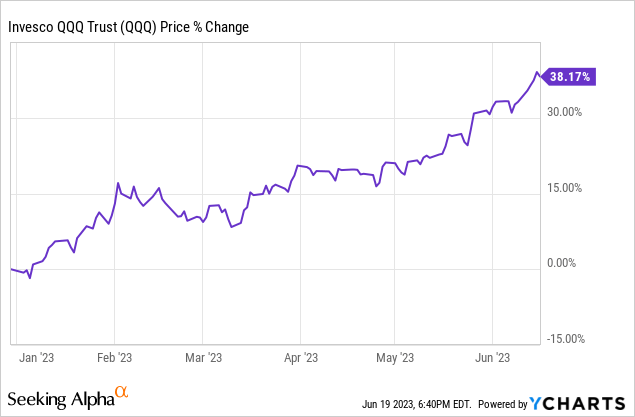

According to data from Nasdaq, QQQ has increased by an average of 25% year-to-date, showcasing strong earnings reports from major tech firms. However, it’s not without challenges; concerns over inflation, geopolitical tensions, and potential regulatory changes continue to add pressure on tech stocks.

Recent Events Influencing QQQ Stock

Recent earnings seasons have brought both optimism and caution. Major tech firms have reported robust sales and expansion strategies, prompting a surge in stock prices. However, the Federal Reserve’s decision to potentially increase interest rates to combat inflation has created uncertainty, leading to a pullback in tech stocks.

Furthermore, the ongoing semiconductor shortage has raised alarms. Major companies reliant on these components, including automotive and consumer electronics, could face supply chain disruptions, which could indirectly impact the performance of QQQ.

Conclusion

The significance of QQQ stock extends beyond just its price movements; it reflects larger economic trends and investor sentiments toward technology and growth sectors. For retail investors and analysts alike, monitoring QQQ stock can provide valuable insights into the market’s health and future direction.

As we move towards the end of 2023, it is essential for investors to keep an eye on economic indicators and corporate earnings reports that may influence QQQ stock. Forecasts suggest that while the tech sector may face headwinds, long-term growth opportunities remain, suggesting that the QQQ could still present a compelling investment choice for those with a robust risk appetite.