Understanding MSTR Stock and Its Market Implications

Introduction to MSTR Stock

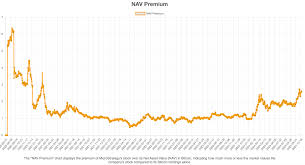

The stock of MicroStrategy Incorporated (MSTR) has recently become a focal point for investors, particularly those interested in the intersection of technology and cryptocurrency. As a business intelligence company that holds significant amounts of Bitcoin on its balance sheet, fluctuations in MSTR stock have often mirrored trends within the cryptocurrency market. Understanding MSTR stock’s performance is essential for investors looking to capitalize on its unique market position.

Recent Developments

As of October 2023, MSTR stock has seen notable volatility, primarily influenced by Bitcoin price movements. Recently, Bitcoin prices surged past $30,000, contributing to a spike in MSTR’s stock value, which climbed more than 15% over the past month. This surge can be attributed to renewed investor interest in cryptocurrencies and MicroStrategy’s ongoing commitment to acquiring more Bitcoin.

On September 27, MicroStrategy announced the purchase of an additional 5,000 Bitcoin, bringing its total holdings to approximately 158,000 BTC. This strategic move not only underscores the company’s bullish outlook on the cryptocurrency but has also reinforced MSTR’s position as a proxy for Bitcoin investment for many stock market participants.

Market Reception

The market’s reaction to MSTR stock has been mixed, with some analysts expressing concern over the high correlation between the company’s stock price and Bitcoin’s volatility. Despite this risk, many investors view MicroStrategy as an innovative play in the tech sector, capitalizing on the potential of blockchain technology and digital currencies.

Furthermore, MicroStrategy’s approach to Bitcoin has sparked discussions about cryptocurrency adoption at the corporate level, attracting both institutional and retail investors. The company’s stock continues to resonate well in tech-focused portfolios, particularly among those who believe in the long-term prospects of Bitcoin.

Conclusion and Outlook

In conclusion, MSTR stock serves as a notable indicator of Bitcoin’s performance and the broader cryptocurrency market. While investors should proceed with caution given the inherent risks associated with cryptocurrency volatility, there remains considerable interest in MSTR as a potential high-reward investment.

Looking ahead, the ongoing developments in both the crypto market and MicroStrategy’s business strategy are expected to shape MSTR stock’s trajectory. With a growing number of corporations embracing digital currencies, the demand for stocks closely tied to Bitcoin, like MSTR, is likely to remain significant in the stock market landscape.