Understanding MSTR: MicroStrategy’s Role in Business Intelligence and Bitcoin

Introduction

MicroStrategy Inc. (MSTR), founded in 1989, has established itself as a prominent player in the business intelligence landscape. With the increasing reliance on data analytics in today’s digital age, MSTR’s tools for organizations to leverage data effectively have gained significant traction. Recently, the company has also made headlines for its substantial investments in Bitcoin, further highlighting its commitment to innovation and strategic growth.

Current Developments at MicroStrategy

As of late 2023, MicroStrategy continues to enhance its suite of business intelligence solutions with advanced features such as artificial intelligence integration and data visualization capabilities. In their latest financial report, MSTR announced a quarterly revenue increase of 12% compared to the previous year, driven by a surge in demand for data analytics services across industries. This growth underscores the critical need for businesses to harness data insights for strategic decision-making.

Bitcoin Investment Strategy

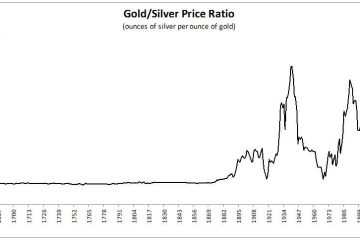

Alongside its business intelligence software, MicroStrategy has gained notoriety for its aggressive Bitcoin investment strategy. As of October 2023, the company holds approximately 152,000 Bitcoins purchased at an aggregate price of over $4.5 billion. This bold move, spearheaded by CEO Michael Saylor, has positioned MicroStrategy not just as a software company but as a significant player in the cryptocurrency space. The firm recently reiterated its belief in Bitcoin as a digital gold and a hedge against inflation, indicating no plans to sell any of its holdings in the foreseeable future.

Impact on the Market

MicroStrategy’s dual focus on business intelligence and cryptocurrency has had a noticeable effect on both sectors. The company’s consistent investment in Bitcoin has contributed to growing institutional interest in cryptocurrency as an asset class. At the same time, MSTR’s ongoing enhancements to its business intelligence platform promote a culture of data-driven decision-making, influencing companies worldwide to prioritize analytics in their operational strategies.

Conclusion

The future for MicroStrategy looks promising as it balances its core competencies in data analytics with bold ventures into the cryptocurrency market. As companies across various sectors continue to adapt to the complexities of data and digital assets, MSTR stands prepared to meet these challenges head-on. Investors and business leaders alike should keep a close eye on MicroStrategy’s innovative offerings, as they could shape the future landscape of business intelligence and cryptocurrency investing.