Understanding Interest Rates in Canada: Current Trends

Introduction

Interest rates are a crucial element in Canada’s economic landscape, influencing everything from mortgage rates to consumer spending. As the Bank of Canada sets its benchmark interest rate in response to economic conditions, understanding these rates becomes increasingly important for Canadians. Recent fluctuations have raised concerns about affordability and economic stability, highlighting the relevance of this topic for consumers, businesses, and policy-makers alike.

Current Trends in Interest Rates

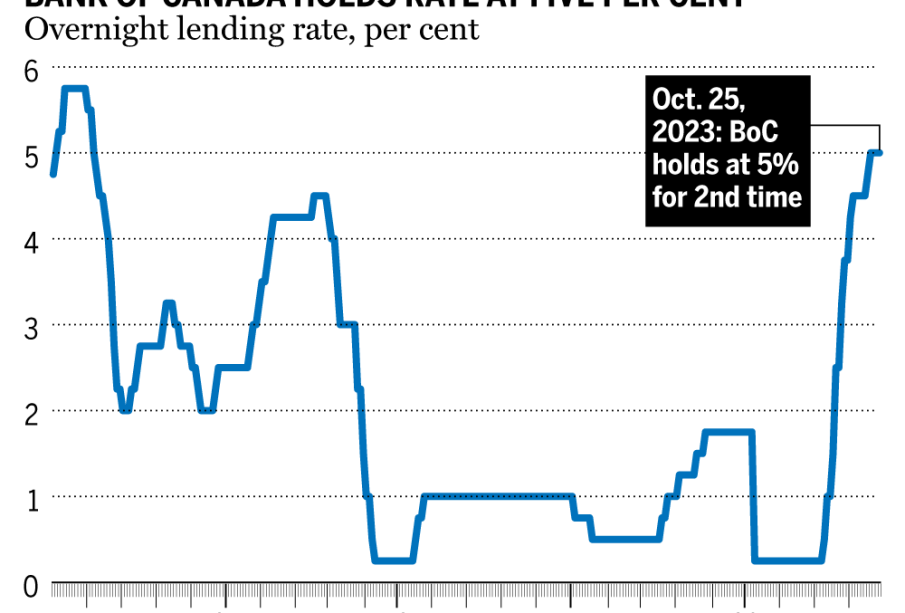

As of October 2023, the Bank of Canada has maintained a key interest rate of 5.0%, unchanged from previous months. This rate was set in response to efforts to combat inflation, which has seen significant increases over the past year. The central bank aims to stabilize prices while also supporting economic growth, balancing the needs of consumers and markets.

In August 2023, inflation rates in Canada held at 3.3%, a slight decrease from earlier in the year, which prompted discussions regarding potential shifts in monetary policy. The Bank of Canada has indicated that while rates may remain high for the foreseeable future, they are keeping a close watch on economic indicators to reassess their strategy as needed.

Impact on Canadian Consumers

The current interest rates impact various sectors, particularly housing and consumer loans. For homebuyers, higher interest rates mean increased costs for mortgages, which can lead to a slowdown in the housing market. Many Canadians are facing pressure as monthly mortgage payments rise, prompting some to reconsider their purchasing decisions.

On the other hand, higher interest rates can benefit savers, as financial institutions have started offering better rates on savings accounts and fixed-term deposits. This shift encourages Canadians to save rather than spend, which could have long-term implications for economic growth.

Looking Ahead

The outlook for interest rates in Canada remains uncertain in the wake of global economic changes. Experts suggest that the Bank of Canada will remain cautious about making any drastic moves until there is clearer evidence regarding inflation control and economic stability. As we advance towards the end of the year, the importance of understanding interest rates will be even more critical for Canadians to make informed financial decisions.

Conclusion

The fluctuations in interest rates in Canada underscore the complexity of the economic environment and the impact of various factors such as inflation and global markets. As an essential consideration for consumers and businesses alike, staying informed about interest rates remains vital. Canadians are advised to monitor financial news and economic forecasts regularly to better navigate their financial landscapes in the months to come.