Understanding Inflation Trends and Predictions for 2025

Introduction

Inflation has been a critical concern for economies worldwide, particularly in the aftermath of the COVID-19 pandemic. As countries begin to recover and adjust to new economic realities, the anticipated inflation rates for 2025 have garnered significant attention from economists, policymakers, and the general public. Predicting inflation is crucial as it affects purchasing power, interest rates, and overall economic stability.

Current Trends Leading to 2025

As we approach 2025, several key factors are expected to shape inflation trends. Firstly, supply chain issues that arose during the pandemic are gradually improving, but disruptions continue to ripple through various sectors. The ongoing conflict in Eastern Europe and geopolitical tensions have also contributed to fluctuations in energy prices, which play a significant role in inflation.

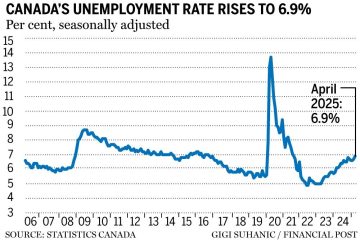

According to the Bank of Canada, inflation rates are projected to stabilize as the economy adjusts. The central bank has indicated its willingness to implement monetary policies aimed at curbing inflation, including potential interest rate hikes. These measures are essential as many Canadians continue to navigate the impacts of increased living costs, including housing and food prices.

Global Economic Influence

The global economy’s interconnected nature means that inflation in one region can impact economies elsewhere. As countries strive for economic recovery, factors such as international trade agreements, supply chain resiliency, and investment in green technologies will also influence inflation prospects for 2025.

Predictions for Inflation in 2025

Economic forecasts suggest that inflation could stabilize around the Bank of Canada’s target of 2%. However, analysts warn that uncertainty remains due to potential shocks in commodity prices or shifts in consumer demand as new behaviors developed during the pandemic persist. Research from various financial institutions highlights a need for vigilance and adaptive policy measures to address unexpected inflationary pressures.

Conclusion

As we look towards 2025, understanding inflation dynamics is essential for both policymakers and consumers. With ongoing economic recovery efforts and potential global challenges, monitoring inflation rates and implementing effective strategies will be crucial for sustaining economic growth. Canadians are advised to stay informed on these developments, as inflation will continue to influence their economic landscape over the next few years.