Understanding Google Stock Price Trends in 2023

Introduction

The stock price of Google, under its parent company Alphabet Inc. (GOOGL), remains a significant topic for investors, analysts, and market watchers. Given its impact on the global tech landscape, understanding the factors affecting Google’s stock price is crucial for making informed investment decisions. With the ongoing shifts in technology, advertising revenues, and global economic conditions, the relevance of monitoring Google’s stock price cannot be understated.

Current Market Overview

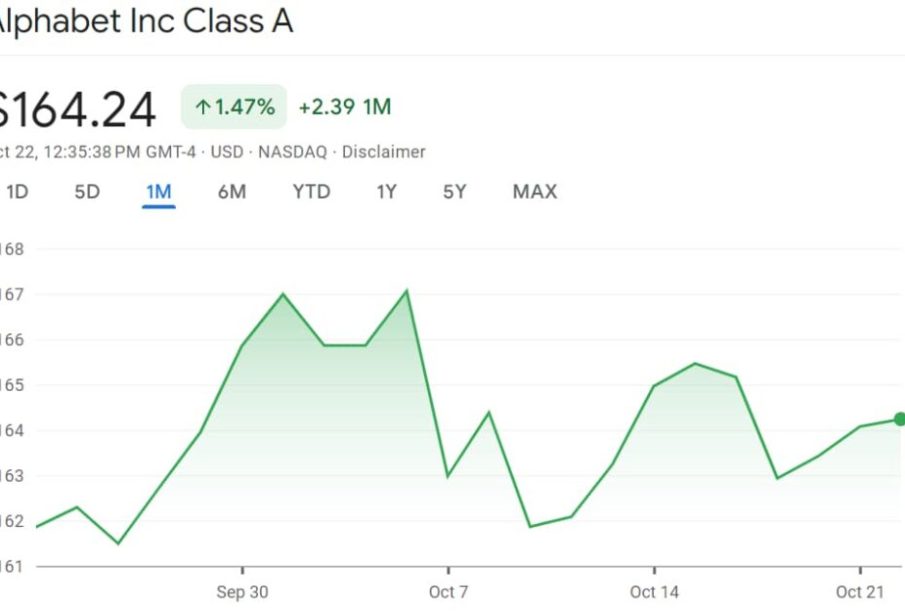

As of October 2023, the stock price for Google hovers around CAD 145, reflecting a year-to-date growth of approximately 24%. The recent performance can be attributed to steady revenue growth from its advertising business and an expanding cloud division. Furthermore, the tech sector has shown resilience against market fluctuations, providing a favorable environment for major players like Google.

Key Drivers of Google’s Stock Price

- Advertising Revenues: Google remains the largest digital advertising platform globally. Despite fluctuations in advertising budgets during economic uncertainties, Google has consistently managed to retain a strong market share, largely due to its dominance in search and video advertising through YouTube.

- Cloud Computing Growth: Alphabet’s cloud services have seen substantial growth. The latest earnings report showcased a 33% increase in cloud revenue year-over-year, which has been a significant contributor to the overall positive outlook for Google’s stock price.

- Innovations in AI: Google’s continuous investment in artificial intelligence and machine learning has positioned the company as a leader in the tech industry. As businesses across various sectors increasingly adopt AI technologies, Google stands to benefit immensely.

Market Challenges

Despite these positive indicators, Google also faces challenges. Regulatory scrutiny in various markets, including recent antitrust actions in the U.S. and Europe, could impact the company’s operational strategies and ultimately, its stock price. Additionally, competition from companies like Microsoft in cloud computing and artificial intelligence presents significant pressure for sustaining growth.

Conclusion

Monitoring Google’s stock price is essential due to its impact on the tech industry and the broader market. With analysts forecasting continued growth in advertising and cloud services, many view Google’s stock as a robust long-term investment. However, ongoing regulatory scrutiny and competitive pressures introduce an element of risk. As we advance into 2024, staying updated on these factors will be crucial for investors and stakeholders alike.