Understanding Gold Price Trends in Canada

Introduction

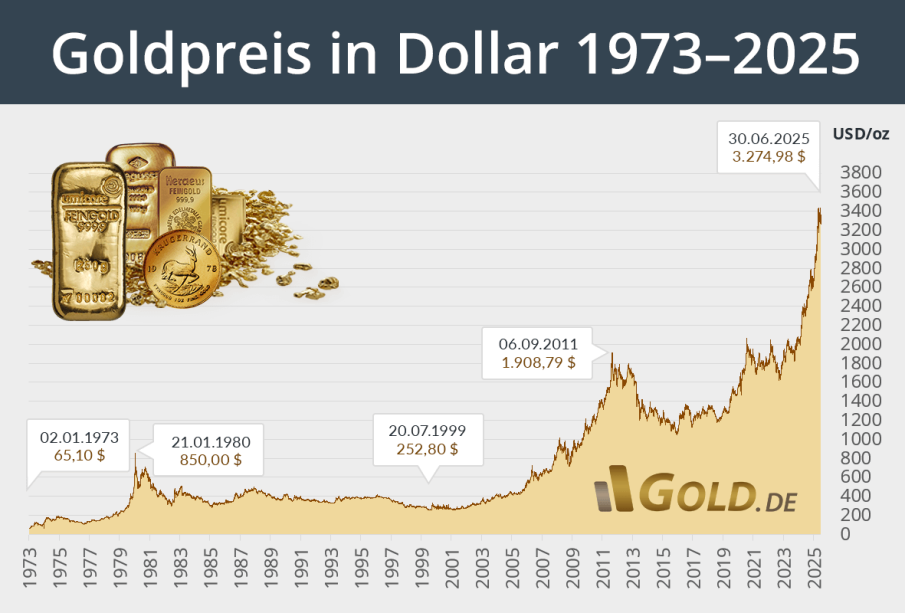

The gold price holds significant importance in the financial world, serving as a safe-haven asset for investors and a key indicator of economic stability. In 2023, fluctuations in gold prices are drawing attention as they reflect global economic trends, inflation rates, and geopolitical tensions. Understanding these dynamics is crucial for both seasoned investors and newcomers looking to navigate the financial market.

Current Trends in Gold Prices

As of October 2023, the price of gold has experienced notable volatility. Currently, gold is trading at approximately CAD 2,650 per ounce. This represents an increase of around 10% from the previous year, largely attributed to rising inflation and economic uncertainty stemming from ongoing geopolitical conflicts, particularly in Europe and the Middle East. Analysts note that as central banks continue to grapple with interest rate hikes, investors are turning to gold as a hedge against currency fluctuations.

Factors Influencing Gold Prices

Several factors contribute to the fluctuation of gold prices, including:

- Inflation: With inflation rates climbing globally, gold often serves as a reliable store of value. Recent data shows that Canada’s inflation rate is hovering around 5%, leading many investors to increase their gold holdings.

- Interest Rates: The Bank of Canada has raised interest rates several times this year to combat inflation, affecting the opportunity cost of holding gold. As interest rates rise, gold may experience downward pressure. However, current economic uncertainty has kept gold prices buoyant.

- Geopolitical Tensions: Ongoing conflicts can lead to increased demand for gold. The Russia-Ukraine war continues to destabilize markets and push investors toward gold for security.

Conclusion

The gold price is a crucial indicator of economic health and investor sentiment. With the current trends indicating that gold remains a preferred asset in unpredictable economic times, it seems likely that demand will persist, potentially driving prices up in the near future. Investors should remain vigilant and informed as the complex interplay of market conditions unfolds. The ongoing geopolitical issues and inflationary pressures will likely shape the gold market in the coming months, making it a key asset to watch in 2023 and beyond.